The XAU/USD pair ended the day up nearly 1% as the dollar took a breather from its recent rally. In the latest economic data, Markit's manufacturing index came in at 54.7, down from the previous month's 55.9 and below expectations for a reading of 56.2. The Federal Reserve Bank of Philadelphia said its index of regional manufacturing activity climbed to 40.8 from 20.7 the prior month while the Labor Department reported that the number of first-time applicants for jobless benefits decreased to 291K from an upwardly revised 293K

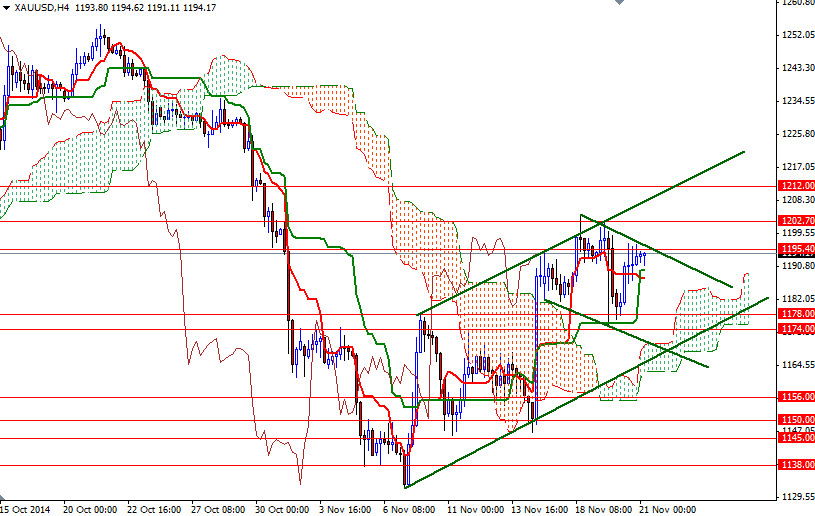

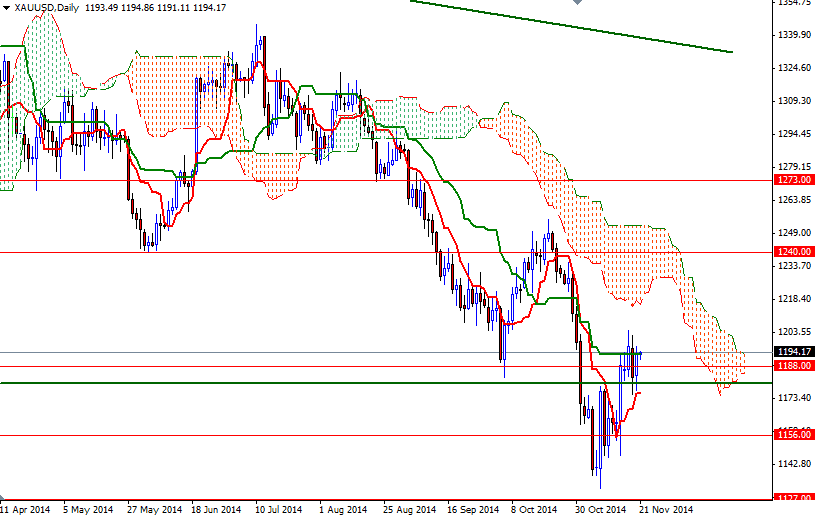

Gold prices tried to break through the first barrier, that I mentioned often lately, around 1195 but the bears has managed to block the bulls' advance so far. Although prices are still feeling the bearish pressure caused by the dominant down-trend, the XAU/USD is currently sailing above the Ichimoku clouds on the 4-hour time. That makes me think that there might be some more room to the upside. In other words, there is a possibility of visiting the 1225 - 1240 area before making new lows. If the bulls want to gather their strength and reach that far, they will have to face with tough challenges such as 1202.70 and 1212.

On the other hand, if the bears manage to dodge incoming attacks and prices start to drop, we may return to 1178/4 support zone where the Tenkan-sen (nine-period moving average, red line) resides on the daily chart. Breaking below this area would suggest that the market is aiming for the 1268/6 level. Only a daily close below the 1245 support level could increase speculative selling pressure and clear the part towards 1127.