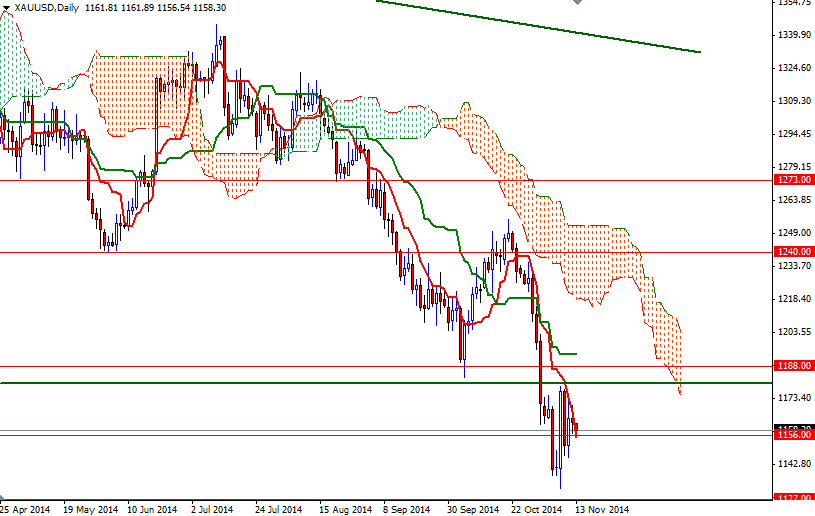

Gold prices closed lower on Wednesday, giving back a portion of the previous day’s gains, as the greenback edged higher. The XAU/USD pair is currently trading at $1158.30 an ounce but the trading range is narrowing. Yesterday's price action resulted in an inside day pattern indicates indecision. There is no major U.S. economic data on the calendar today and apparently people are wondering if current demand for physical gold is sufficient to keep the market supported and lift prices to previous levels.

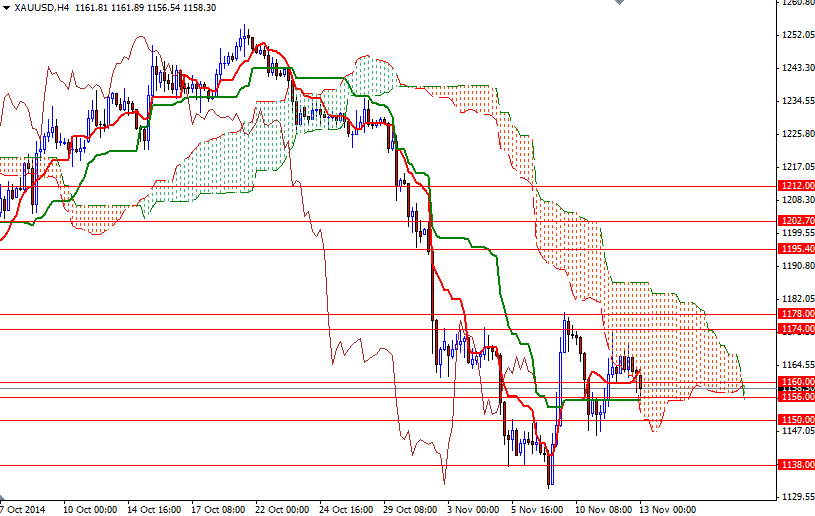

From a technical perspective, I expect the market to maintain its negative bias unless we make it back above $1183/0. That particular region is not only the top of the Ichimoku cloud on the 4-hour time frame but a former support which held the market up from June 2013 to mid-October 2014 as well. In other words, until the market anchors somewhere above the 1183 level, prices will continue to remain under pressure and grind lower towards 1088.

Meanwhile, I am going to keep an eye on the 1170 and 1156 levels. Trading within the boundaries of the Ichimoku cloud (4-hour chart) suggests there is an intense battle going on between the bears and bulls. If the XAU/USD pair stays above the 1156 level, I think the bulls will try to approach this first hurdle. Clearing the resistance at 1170 would open the doors to the 1174 and 1178. However, if the market dives below the 1156 level, it is likely that we will see the pair testing the next supports at 1150 and 1145.