Gold prices climbed to three-week highs on Friday after China's surprise rate cut added to optimism about the global economy. The XAU/USD pair closed the week higher for the third week in a row but it appears that, after months of treading water, people want to see if recent price gains stick before getting more aggressive. Friday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions in gold to 81422 contracts, from 56043 a week earlier.

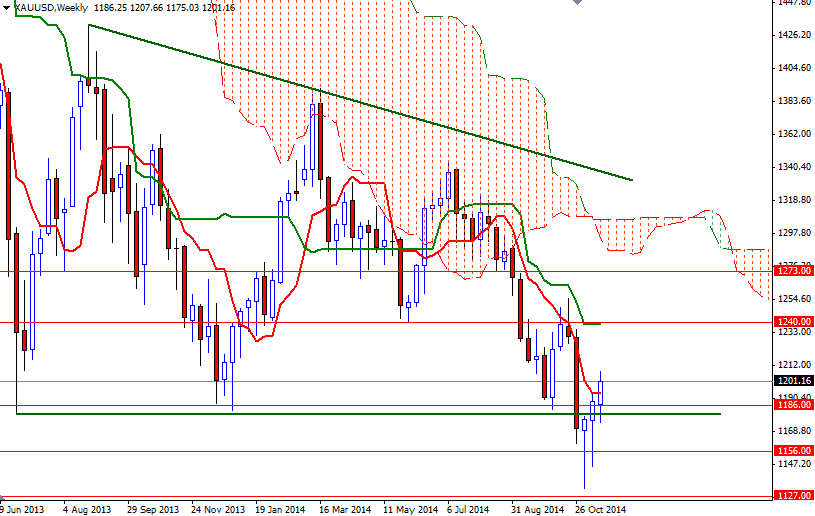

The market is keeping a wary eye on the latest developments in Ukraine. Simmering tensions between Russia and Ukraine have resurfaced again recently and this should be supportive for the precious metal in the near term. While Russia still denies Ukrainian and Western accusations that it is supplying the rebels with military aid, U.S. Vice President Joe Biden said "We’ve seen more provocative action, more blatant disregard for the agreement signed not long ago by Russia. As long as that continues, Russia will face a rising cost and greater isolation". Despite gains in prices for the yellow metal over the past three weeks, the long-term fundamental reasons to hold gold are getting smaller.

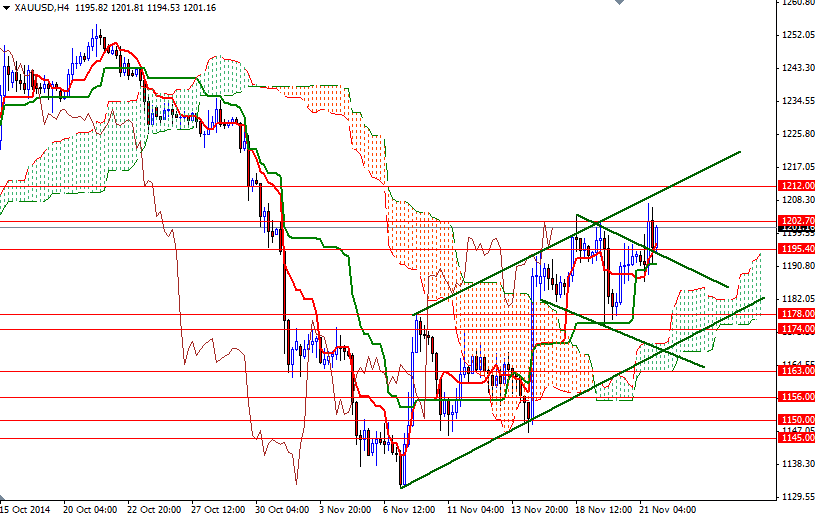

However, the short-term technical outlook for the XAU/USD pair has shifted to the upside lately. The market spent the whole week above the Ichimoku clouds on the 4-hour time frame. In addition to that, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-day moving average, green line) are positively aligned. Because of that, it is technically possible to see prices rising towards the daily Ichimoku cloud. On its way up, expect to resistance at 1207, 1212 and 1222. If the bears increase the downward pressure and prices start to retreat, support may be found at 1286/4.50 and 1178/4. Below that, the bulls will be waiting around 1166/3.