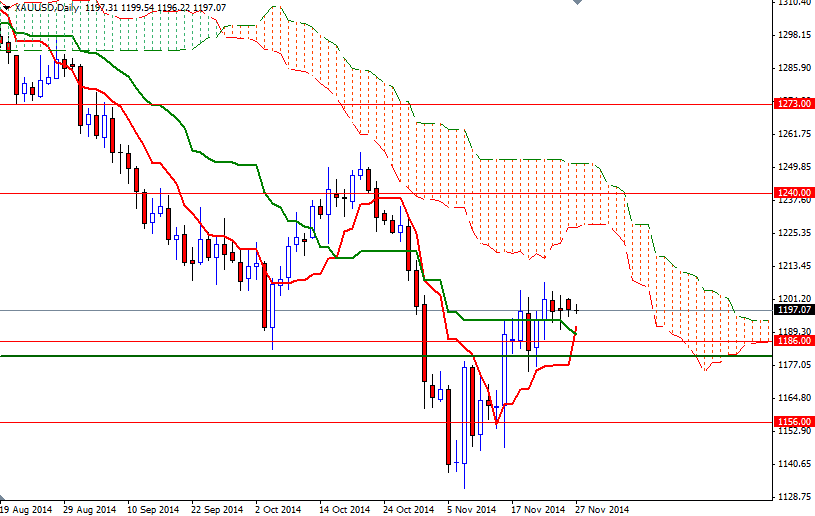

The XAU/USD pair closed yesterday's session slightly lower than opening but remain coiled within the recent trading range as a mixed bag of economic reports failed to inspire market players ahead of the Thanksgiving holiday. The Commerce Department said orders for durable goods rose a seasonally adjusted 0.4% in October from a month earlier and the Labor department reported weekly jobless claims jumped 21K to 313K. Chicago purchasing managers' index came in weaker than expected with a print of 60.8 and a separate report released by the University of Michigan showed its consumer sentiment index rose to 88.8 from 86.9.

Narrowing trading range indicates that investors are reluctant to make aggressive bets in a thin market. Markets in the U.S. will be closed due to Thanksgiving holiday today and trading during the Asian session seems quite muted already. Meanwhile, I will keep an on the 1191 and 1212 levels, as I think the market will have to breakout eventually.

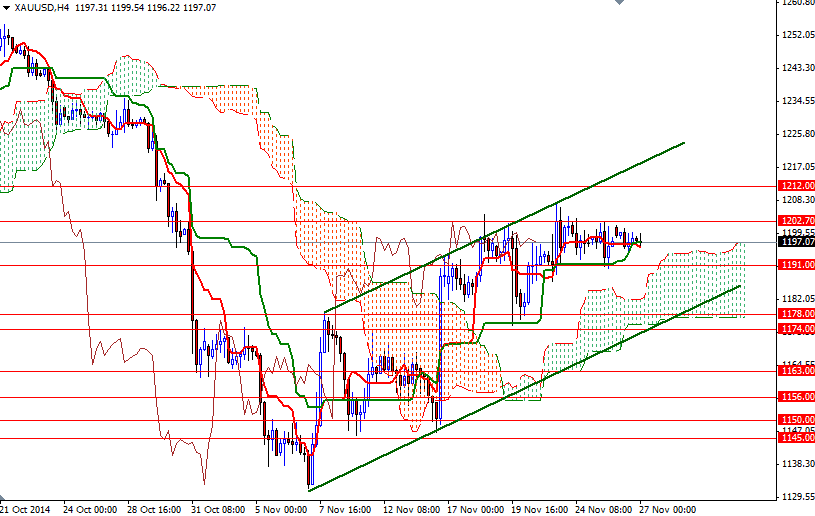

The bulls have been trying to establish a short-term uptrend while holding the market above the Ichimoku clouds on the 4-hour chart but the bears still have the medium-term technical advantage. If the bulls shatter the first barrier ahead of them (1203), then it may be possible to see the XAU/USD pair testing the next resistance levels at 1207 and 1212. However, the inability to pass through 1203 could lead to further downward pressure. In that case, I think we are going to revisit the support at 1191. If the bears manage to push prices below the 1191 level, expect the market head towards the 4-hour cloud. The top of the cloud currently sits around 1186. The bears will need to capture this base if they intend to reach the 1174 support level.