Gold prices ended Thursday nearly unchanged as the bulls and bears struggle for near-term control, with neither gaining an edge. The XAU/USD pair traded as high as $1167.89 after the Labor Department reported that the number of first-time applicants for jobless benefits increased 12K to 290K but the mild disappointment didn't have a long lasting affect. The market has been stuck in a tight trading range (roughly between $1156 and $1170) since Wednesday.

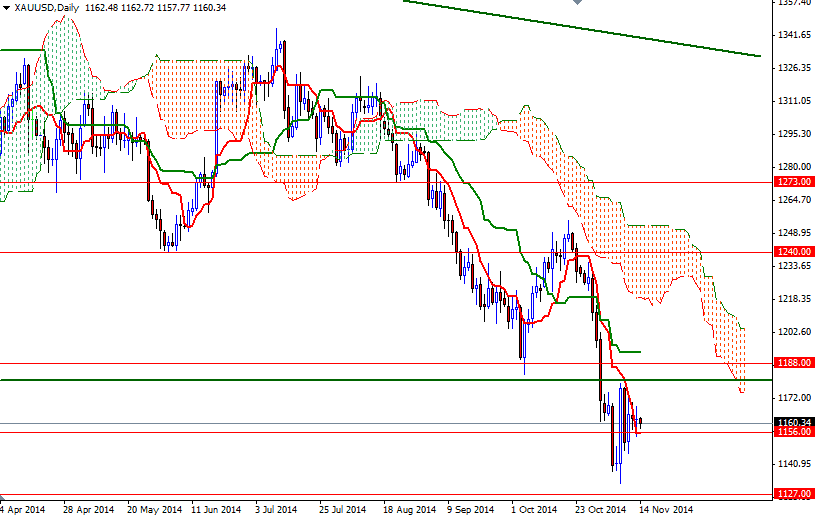

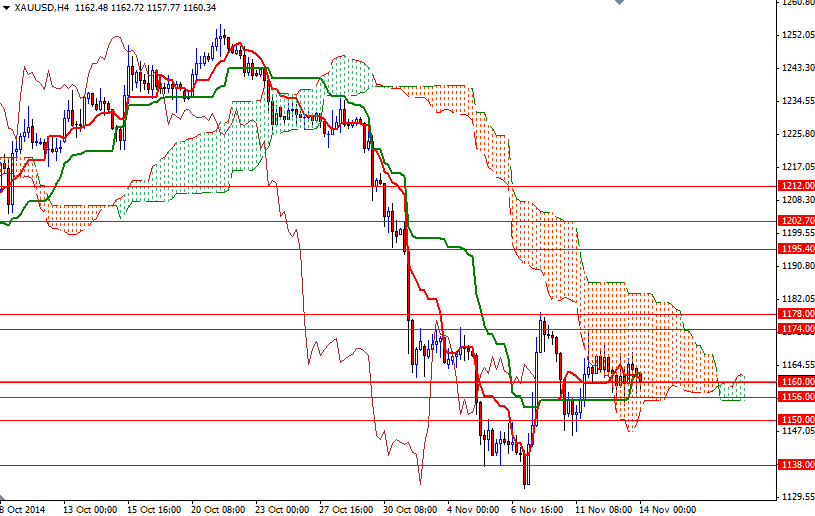

From a technical point of view, the 4-hour chart suggest that the market is neutral while trading inside the Ichimoku clouds and the candlesticks indicate lack of momentum at the moment. This narrow trading range seems to be boring but eventually the market will soon reach a point where it will simply have to break one way or the other. At this point, I will simply wait for a breakout before I pull the trigger.

If the bulls build some steam and shatter the 1170 barrier, XAU/USD will probably gain enough momentum to test the 1174 and 1178 levels. The real challenge will be waiting the bulls in the 1183/8 zone. If a bearish breakout occurs and the market leaves the cloud, I think we will test the 1150 support level next. The bears have to drag prices below 1145 so that they can retest the support at 1138.