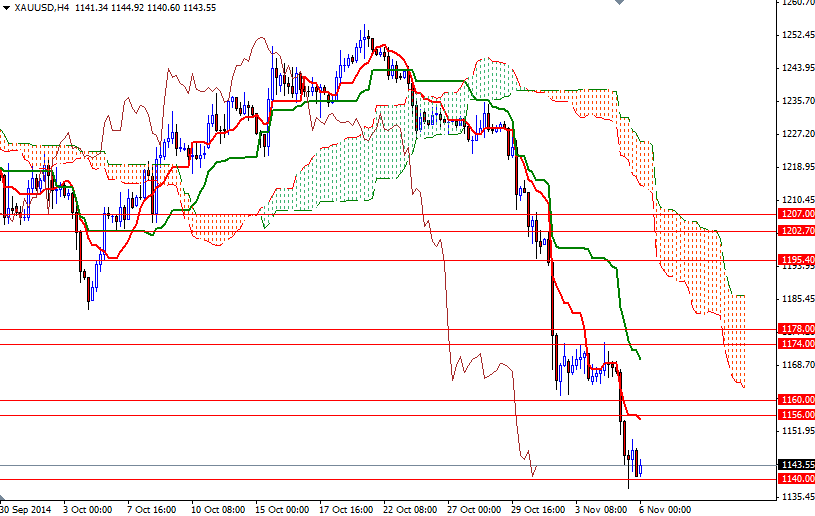

The XAU/USD pair fell during the course of the day on Wednesday, breaking into new lows. The pair accelerated its decline after the bears dragged prices below a critical support level of $1156 and touched the lowest level since April 23, 2010. The risk-on attitude across global markets and increases in value the dollar continue to influence the price of gold, and because of that investors have been reluctant to go long - especially while the U.S. economy is doing well. The ADP Research Institute said companies added 230K employees in October after an upwardly revised 225K gain in the prior month and data released by the Institute for Supply Management revealed that its non-manufacturing index declined to 57.1 from 58.6.

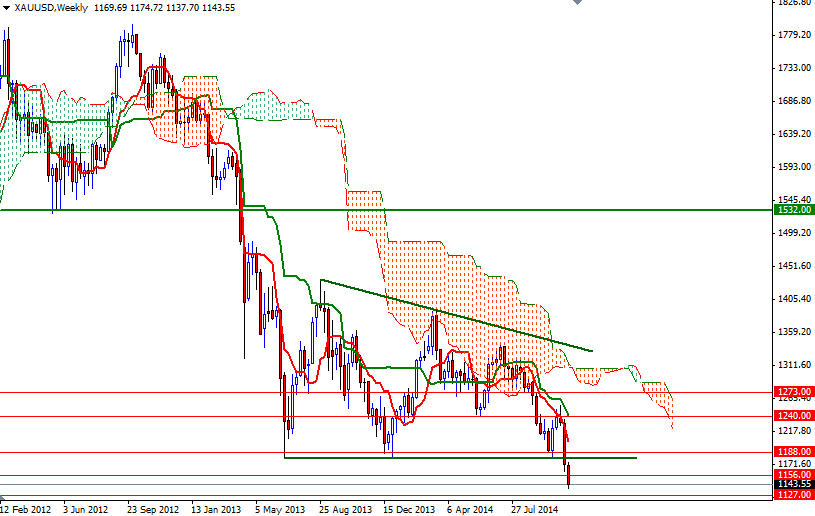

Just a glance at these charts shows how weak gold has been. The bears have been dominant for a quite long time and the fact that we broke below the 2013 low of $1180 reminds me that there is no point in trying to catch a falling knife. After all, the market conditions are way different from just a few years ago, so at this point I can't think of a reason to start buying. Recent candles tells me that there is more strength behind the bears and we might go deeper, probably heading down to the $1088 level, which is the next significant support area on the longer-term charts.

However, the market is certainly oversold and there are important events ahead of us such as the ECB meeting and the U.S. non-farm payrolls report. From an intra-day perspective, I think the key levels to watch will be 1140/37.50 and 1156/4. If the XAU/USD pair drops below yesterday's low, it is likely that we will see the pair testing the next support level at 1127. If the bulls gain some strength and the pair manages to pass through 1156/4 area, they might have a chance to tackle the 1160 resistance level. A daily close beyond this zone could ignite some profit taking and increase the possibility of a bullish attempt to test 1178/4.