By: Stephanie Brown

Over the past couple of months, there were ramblings in the financial markets as to how Bitcoin has lost steam. Many investors avoided Bitcoin due to its high-volatility issues that it still must overcome. Additionally, improvement in world-equity markets caused the crypto-currency to plummet. However, the Bank of Canada is currently considering the pros and cons of the Bitcoin. At the current moment, it considers Bitcoin as just a financial asset, but many industry analysts believe that once Bitcoin is able escape the negative press, it should easily become more acceptable.

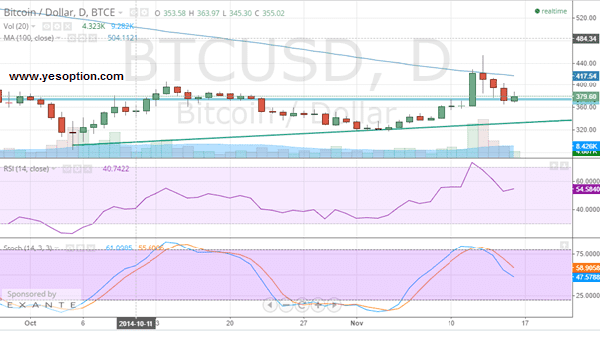

The BTC/USD was unable to move above its resistance as its 100-day moving-average is at $417. It recently experienced some intense selling pressure, which caused the crypto-currency to plummet well below its important support zone of $375. In today’s trading session, the BTC/USD moved above its resistance zone but was unable to sustain itself, which is negative for the digital currency going forward.

The sell-off in the BTC/USD over the past couple of days was due to heavy volumes, which is a bearish indicator, and suggests that the bears are in total control at the current moment. The stochastic oscillator for the BTC/USD is providing a clear sell signal, which is indicative of a shift in momentum towards the sell side. Lastly, the relative strength index is additionally providing a sell signal, which analysts find troubling.

Actionable Insight:

Short the BTC/USD if it moves below $373 for an intermediate target at $321, with a strict stop-loss above $390

Long the BTC/USD if it moves above $400 for an intermediate target at $451, with a strict stop-loss below $375.