By: Stephanie Brown

According to many industry experts, Bitcoin is primed for greater expansion in the near future. Bitcoin, which has recently been associated with negative news surrounding its regulatory hurdles, such as MT Gox and Silk Route, is now rapidly emerging as the currency of choice for people, as the overall value of paper currency continues to depreciate.

Countries like Greece and Argentina, which have seen their currency depreciate to astonishingly low levels, along with the imposition of capital controls, are swiftly emerging as Bitcoin consumers.

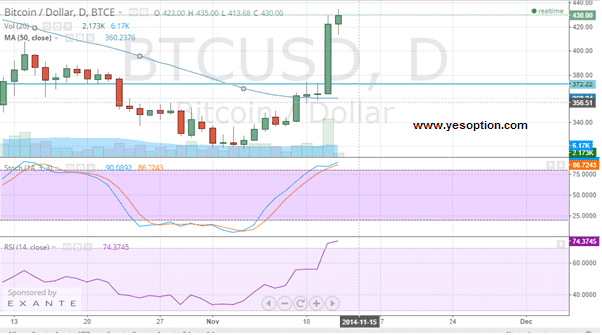

The BTC/USD experienced a tremendous gain during yesterday’s trading session. The crypto-currency not only broke above its resistance zone at $371 but additionally surpassed its psychological resistance zone at $400. The upwards move was due to above average volumes, indicative of strong buying interest present at current levels. The BTC/USD was also able to move above its important 50-day moving average of $360.

The price-action strength is continuing this morning, as the BTC/USD is displaying no signs of reversing. Additionally, its stochastic oscillator is comfortably sitting in the overbought zone, but is showing no signs of a retreating. Furthermore, the relative strength index for the BTC/USD is forming a higher-high which is undoubtedly a bullish symbol.

Meanwhile, support for the BTC/USD is now situated at $400. Additionally, because of the price-action that was exposed yesterday, the BTC/USD reversed its lower-high and lower-low.

Actionable Insight:

Long the BTC/USD at current levels for a price target at $457, with a stop loss below $418.

Short the BTC/USD if it moves below $400 for a price target at $371, with a stop loss above $421.