By: Stephanie Brown

Netflix, Inc. (NASDAQ:NFLX) is in the midst of legal proceedings against Mike Kail its former vice president of information technology operations, accusing him of fraud, breaching his fiduciary and a host of other charges. Kail was responsible for buying computer accessories, as well as other services from outside companies. It is alleged that during his tenure in Netflix, Kail secretly made himself a middleman in a number of transactions, consequently charging a number of suppliers referral fees for anything that was supplied under his docket.

Netflix claims that it ordered tech services without realizing that suppliers were actually paying extra fees to a company on the side, Unix Mercenary, which Kail himself signed the invoices. Investigations reportedly started when Kail left the giant video streaming company to join Yahoo as its CIO. It is being reported that Kail consulting fees ranged anywhere between 12-15%.

Netflix pointed out that Kail arranged Netflix contracts with various IT companies such as Vistara and NetEnrich and would subsequently pocket commissions of the monthly fees that Netflix paid to each company. Vistara, for example, charged Netflix $105,000 for work done in the month of December, whereby Kail walked away with $15,750. Kail could have walked away with $490,000 in kickbacks after Netflix reportedly paid the two companies $3.7 million.

According to the lawsuit, Kail additionally engaged in secret dealings with other outside companies that awarded him gift cards, as well as stocks. Netflix began investigations after it spotted suspicious contracts with outside companies. The giant video streaming company reportedly discovered it had been locked out when it tried to analyze contracts signed by Kail in its DigiSign electronic records account, as the former employee resorted to using personal email account.

Kail has worked in IT departments of a number of companies, accruing over 20 years’ worth of experience. He is currently a board member of a number of startups, including Avegant and cloud provider ElasticBox. It is still unclear how Yahoo will react to these revelations especially as more allegations are expected to unfold.

Technical Analysis

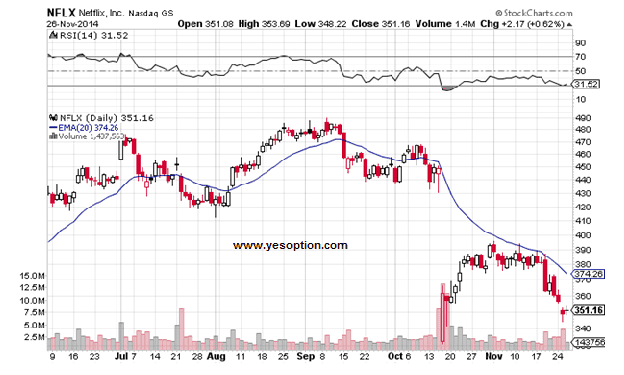

Woes continue for Netflix as the stock is trapped in a downtrend. Currently it is trading well below its 20-Day EMA of $374.26 with its RSI indicator rising marginally. There is no clear direction for the stock as of now. A close above $360 would mean that the stock should move up.

Actionable Insight

Due to high volatility levels, range trade Netflix.