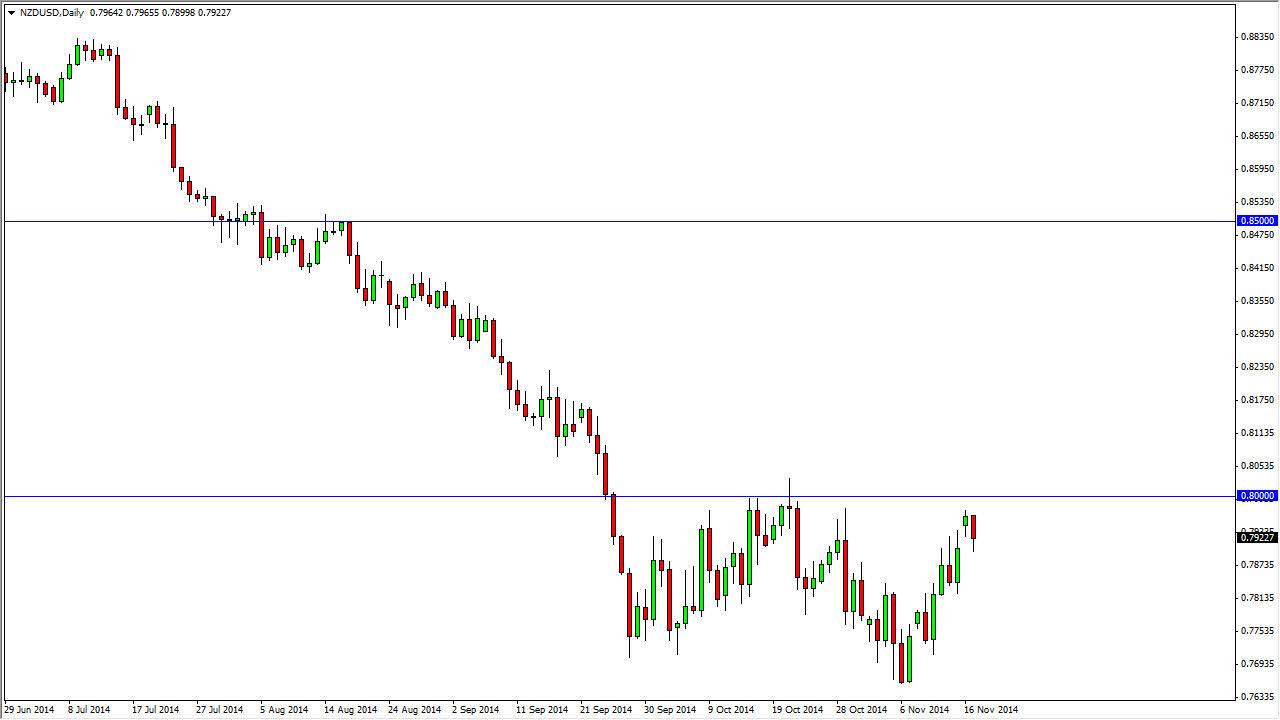

The NZD/USD pair initially gapped higher during the open on Monday, but failed at the 0.80 handle. With that being the case, the market looks like it’s ready to continue the downward trend, if we can break down below the bottom of the candle for that particular trading session. If we get that move, which is essentially a break below the 0.79 handle, I believe that the market will continue to go much lower, aiming for at least the 0.77 handle, which would be the bottom of the recent consolidation that we have seen in this marketplace.

The Royal Bank of New Zealand has recently entered the Forex markets to bring down the value of the Kiwi dollar, directly intervening. This of course is very negative when it comes to the value of this particular pair, especially considering that the Royal Bank of New Zealand has suggested that they are looking to see a 0.68 level in this marketplace in order to reach what they assume as “fair value.”

With that being the case, I see no reason whatsoever to buy this market, and it makes this market one that can be sold every time it rallies. I believe that longer-term traders will step in as well, as we have certainly had a strong move lower. Remember, the New Zealand dollar tends to be very sensitive to what’s going on in the commodity markets, which of course look very ugly at the moment.

The US dollar

Let us not forget that the US dollar is the strongest currency in the Forex markets at the moment, and that of course should translate into this particular pair. I think that this market is going to reach for the 0.75 level first, and then eventually down to the 0.70 handle. Whether or not he can reach the 0.68 handle might be another story altogether, but certainly we are going to make a significant run in that overall direction. That being the case, I am very bearish of this market and will continue to be for the foreseeable future.