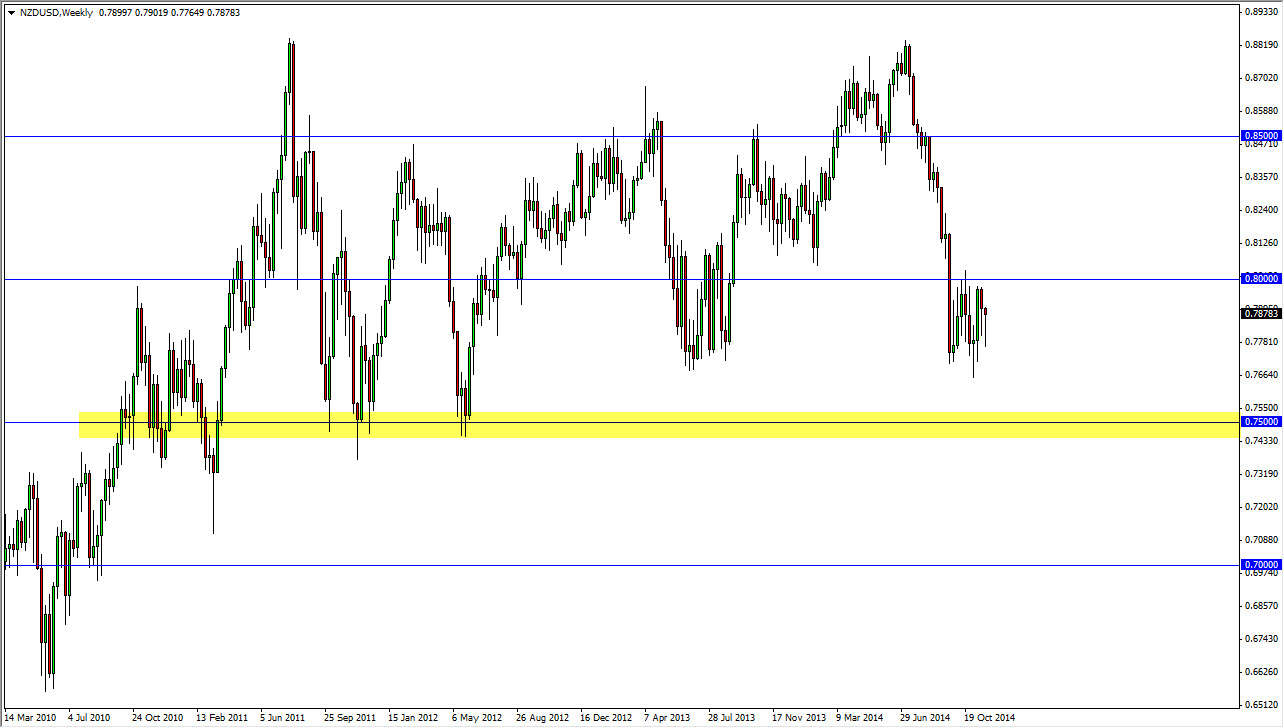

The NZD/USD pair has been grinding away sideways for some time now, as we bounced between the 0.77 level and the 0.80 level. With that, I believe that this market is simply taking a little bit of a rest after the significant sell off that we had seen previously. You can also see a massive red candle that sliced through the 0.80 handle, which is the Royal Bank of New Zealand flexing its muscles to keep the value of the Kiwi dollar down.

In fact, the Royal Bank of New Zealand has recently stated that they believe “fair value” of the NZD/USD pair is somewhere closer to the 0.68 level. Because of this, I believe that we will eventually fall from here, but I recognize that December is kind of a funky month to say the least. However, the New Zealand dollar will be extraordinarily sensitive to the lack of liquidity as it isn’t exactly the most of liquid pair to begin with.

Be careful this month.

Be going to have to be very careful this month, as an already fairly illiquid market is going to become even more erratic due to the fact that volume will drop off in the last two weeks of December. However, I believe that it’s fairly safe to say that the 0.81 level above will bring in quite a bit of selling pressure, which of course starts at the round figure of 0.80 or so. With that, I believe that selling rallies will be the way going forward, as you may perhaps get lucky and see an absolute meltdown to the 0.75 handle. Nonetheless, I would not advise taking a large positions in this pair until January.

Keep in mind that the RBNZ could very well take advantage of the lack of liquidity during the month of December and absolutely pummeled the Kiwi dollar. That’s another reason why don’t want to be long of this currency, and believe that selling is the only thing you can do so. The US dollar remains strong, so I can’t be bothered fighting it. Especially not with this particular currency.