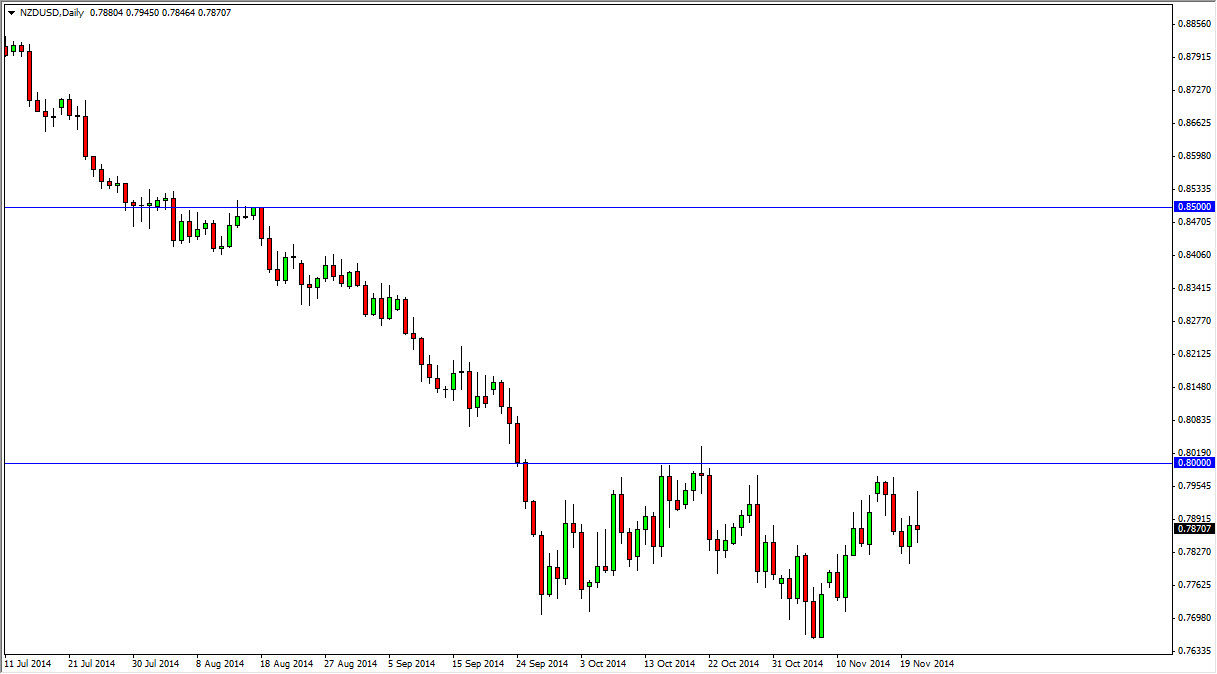

During the session on Friday, the New Zealand dollar tried to rally during most of the day. However, as we approached the 0.7950 region, without enough selling pressure to turn things back around and form a nice-looking shooting star. The shooting star is one of my favorite sell signals, as it shows that the market tried to rally, but simply could not hang onto the gains at all. With this, I believe that we are going to continue the consolidation area that we have seen in this market over the last couple of months, meaning we should then head down to roughly 0.77. This is a nice short-term selling opportunity, but at the end of the day I think that the New Zealand dollar probably breaks down much lower than that anyway.

Remember, the New Zealand dollar is highly sensitive to commodity prices, so would not surprise me at all to see this currency pair are essentially follow the overall commodity index. If that’s the case, we could go much lower as the US dollar continues to strengthen against pretty much everything in the financial world.

Continuation after consolidation

With the Royal Bank of New Zealand looking to push this pair lower and actually stepping into the markets recently, I think that we will see continuation to the downside after some consolidation. This consolidation area is very indicative of how this pair tends to work, as we will go sideways for a couple of months and then have a massively impulsive move to one direction or the other. I believe this is probably due to the fact that this is in exactly one of the most liquid pairs in the world, although it is major enough that most people follow it.

It’s probably only a matter time before we reach towards the Royal Bank of New Zealand’s target. It’s been stated recently that they feel the 0.68 level is more acceptable and closer to being “fair value.” We will more than likely reach towards that area, but we will have to see whether or not we can actually hit that level. Nonetheless, it tells me which direction I should be trading this market.