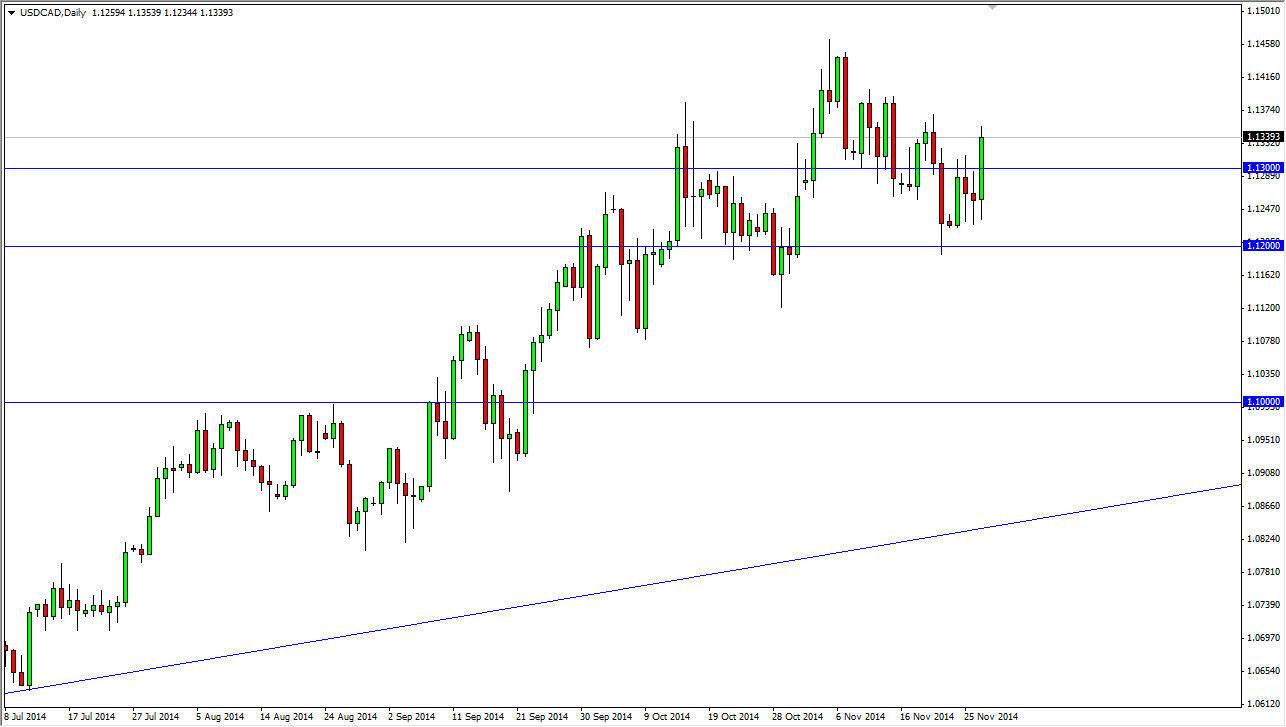

The USD/CAD pair initially fell during the session on Thursday, but as the Americans were way to celebrate Thanksgiving, this pair sliced through the 1.13 level as Canadian dollar weakness continued. This was exacerbated by extraordinarily negative moves in the oil markets, as thin trading certainly added to the erratic nature. OPEC suggested that the output of oil would stay the same, even though we had massively falling and bearish oil markets, which was something that perhaps traders were not anticipating.

Looking at this chart, you can make a serious argument for the 1.12 level being significantly supportive, and therefore it’s not a big surprise that we rose higher. If we break the top of the range, I think that this market will go towards the 1.15 handle, but it will continue to be choppy as his pair tends to be over the longer term typically.

Intertwined economies

These two economies are highly intertwined, so that explains the erratic and choppy nature of this pair. You can see it go sideways for quite some time, and then suddenly move in one direction or the other. I believe that the uptrend is here to stay, and that the 1.15 level will be targeted fairly soon. Because of this, I believe that every dip is value in the US dollar, as it is against most other currencies. After all, the oil markets certainly are not helping the Canadians at all right now.

Money keeps flowing into the United States for reason, as its economy is one of the better performing ones in the world. While the Canadian economy isn’t necessarily bad, it does play second fiddle to the American economy in times like this. With that being said, I believe that the greenback will be the favored currency by most traders around the world for the foreseeable future, and although I do like the Canadian dollar against many other currencies, I cannot bet against the greenback. Ultimately, there’s no way to short this market until we get well below the 1.10 handle, something that I do not see happening anytime soon.