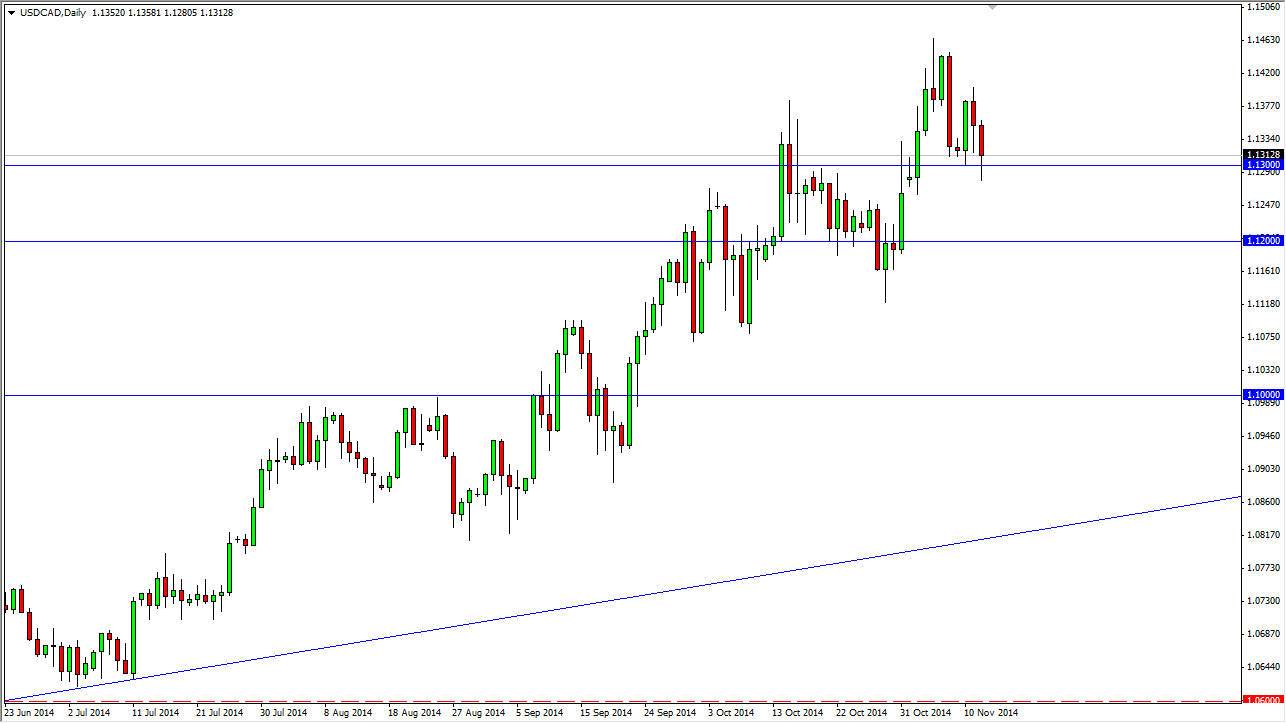

The USD/CAD pair fell during the course of the session on Wednesday, but found enough support at the 1.13 level to turn things back around and form a little bit of a hammer. Because of that, it looks as if the market is going to see buyers stepping in here, and as a result we believe that the US dollar should continue to strengthen against the Canadian dollar. The Canadian dollar has been beaten up for some time now, and as a result I believe that we essentially are trending to the upside.

I think that the pair is going to head to the 1.15 handle, an area which of course is a large, round, psychologically significant area. I think that the level will attract the market like a magnet, and because of this I am looking to buy dips going forward as the US dollar is without a doubt one of the strongest financial instruments in the world right now.

Oil markets

I believe that the oil markets will continue to work against the value of the Canadian dollar, and as a result this market should continue to find plenty of buyers. I believe that the 1.12 level is also supportive, so even if we break down a little bit from here, there should be plenty of buyers below to get involved. It’s only a matter of time before the buyers step in, so at this point in time there is no way to sell this market. I am currently not selling the US dollar against any currency, let alone a commodity currency which of course is going to be very susceptible to weakness at this moment in time.

Ultimately, this pair should continue to grind even higher and I believe that it is a longer-term buy-and-hold type of situation. I think that the choppiness of this pair will typically put off many traders, but if you are more of a longer-term and relaxed type of trader, this is a pair that can do quite well over the longer term.