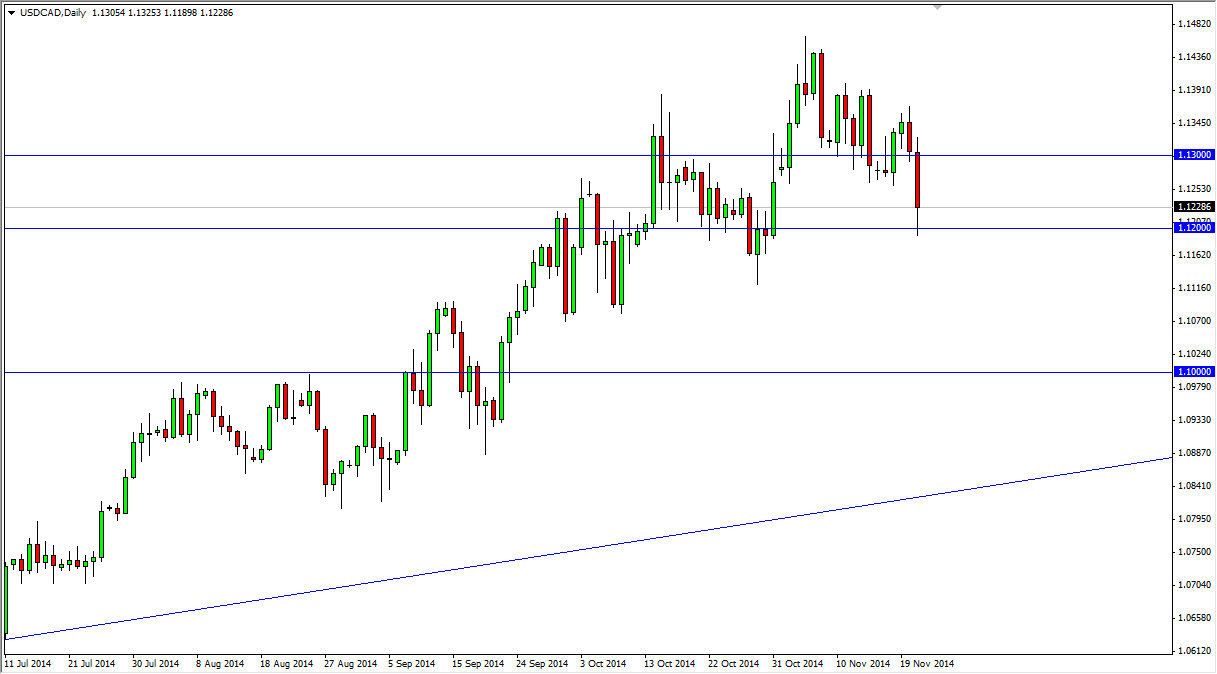

The USD/CAD pair fell rather hard during the course of the session on Friday, testing the 1.12 level. This is an area that has been both supportive and resistive in the past, so it’s not exactly huge surprise that it would offer support during the Friday session. We bounce slightly, but it is a necessarily a strong enough bounce to start buying this pair quite yet. However, I have absolutely no interest in selling this market as the US dollars without a doubt the strongest currency out there right now.

I believe that the Canadian dollar will continue to struggle, especially considering that the petroleum markets are doing so poorly. On top of that, the US dollar is the favored currency by most traders out there anyways, so it’s difficult to go against it in any fashion. With that being the case, I think that we will reach towards the 1.15 level given enough time, but as per usual this pair will be rather choppy. It’s an ugly pair to trade at times, but if you are little bit more patient than the average trader, the prophets to follow.

Following the trend

I have no interest in doing anything the following the trend when it comes to this pair. After all, Canada is used as a proxy for the oil markets, and the oil markets look absolutely horrible right now. On the other hand, the US dollar continues to strengthen against almost everything so it only makes sense of this pair continues to go higher. On top of that, the reality is that Canada’s entire economy is based upon commodities in general and as a result even gold markets can have a little bit of an effect against the Canadian dollar. I see nothing along the horizon that’s going to turn this market around, so I am simply looking for pullbacks going forward as signs of potential value in the US dollar, and looking at support as reasons to start buying this pair yet again. This is more or less a short-term traders pair though, be advised in the sense that the impulsive moves comes suddenly, and then just stop.