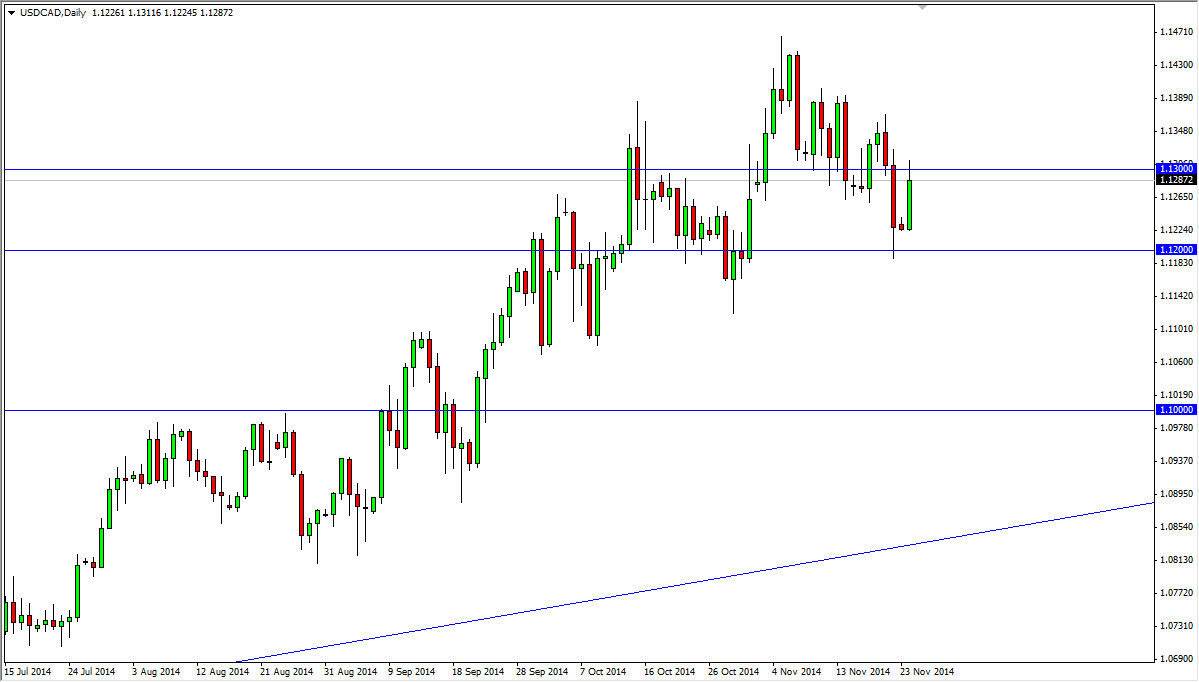

The USD/CAD pair rose during the course of the day on Monday, slamming into the 1.13 level. That area of course offered a bit of resistance as one would expect due to the fact that it was once support, and of course it is a large, round, psychologically significant number. Because of this, I feel that the market may have to pull back a little bit but should be an opportunity for the buyers to get involved in this market going forward. I believe that the 1.12 level should continue to show buying pressure and support.

Looking at this market, we are obviously in an uptrend. Because of that, I have no interest in selling and I do believe that ultimately we will go to the 1.15 level. That being the case, the market looks as if the Canadian dollar will continue to be punished. This is especially true against the US dollar as the oil markets are insignificant trouble.

Oil not helping, America still leading the way

Oil markets of course are not helping the Canadian dollar either, and we have to keep in mind that the US dollar continues to show strength based upon the US economy and the fact that the Federal Reserve is stepping away from the quantitative easing game of course puts a lot of upward pressure on the US dollar in general. Ultimately, I believe that the pair will continue to offer buying opportunities every time it pulls back and it makes sense.

I believe that we will target the 1.15 level, and possibly higher than that. However, this is a pair that tends to grind sideways over a longer period of time, so be aware the fact that you have to be very comfortable with volatility to trade this pair. The two economies are almost completely intertwined so it makes a lot of sense that it’s difficult to hang onto a trade for newer traders. However, if you just follow the trend this is a pair that can pay nice dividends over the longer term. I am bullish.