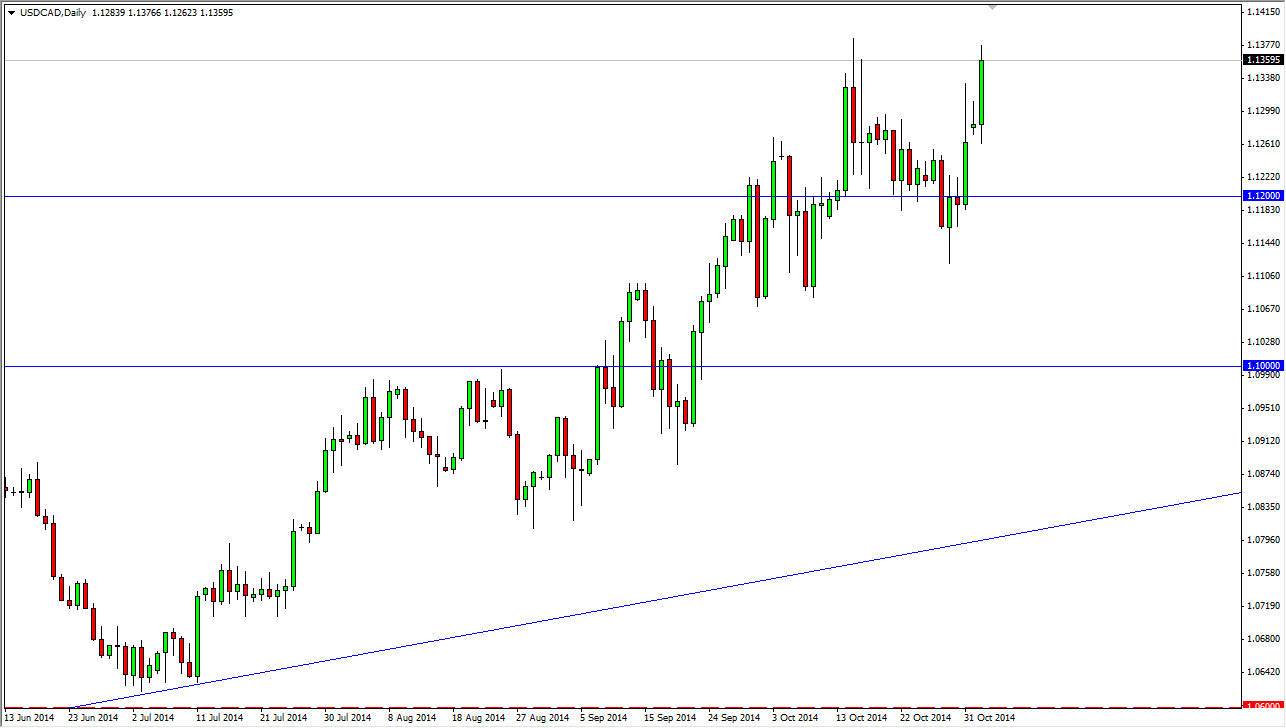

The USD/CAD pair had a very strong showing on Monday, as the pair looks ready to test the 1.14 level for resistance. That area has been resistive recently, so it’s not a big surprise that we stopped there during the session. However, I see nothing on this chart whatsoever that tells me that this pair can get above that level, and head to a more “round number”, such as the 1.15 handle. I think the market will find itself attracted to that level, and as a result it’s probably only a matter of time before we reach it.

I also believe the pullbacks should offer buying opportunities, as a US dollar is without a doubt the most favored currencies around the world. The biggest thing that the Canadian dollar has going for it is that the Canadian economy is essentially “attached” to the US economy. In other words, it gets a little bit of play out of the idea of being a North American currency.

Oil markets

Adding to the misery for the Canadian dollar is the fact that the WTI Crude Oil markets broke through the $80 handle during the session on Monday. Because of this, it appears of the oil markets are going to go much lower, which should in turn push this market much higher given enough time. Because of this, I feel that even if this market pulls back, it should be thought of as “value” as we should then see those bullish of the US dollar jump into the marketplace and begin to push this market higher.

I think that the 1.12 level will of course offer a bit of a “floor” in this market, and most certainly the 1.10 level will as well. With that being said, I don’t really have much in the way of a scenario to sell this market, because I believe that the oil markets are going to continue going lower, the US dollar will continue to strengthen, and although the Canadian dollar will do well against other currencies around the world, its neighbor to the south continues to be the main driver.