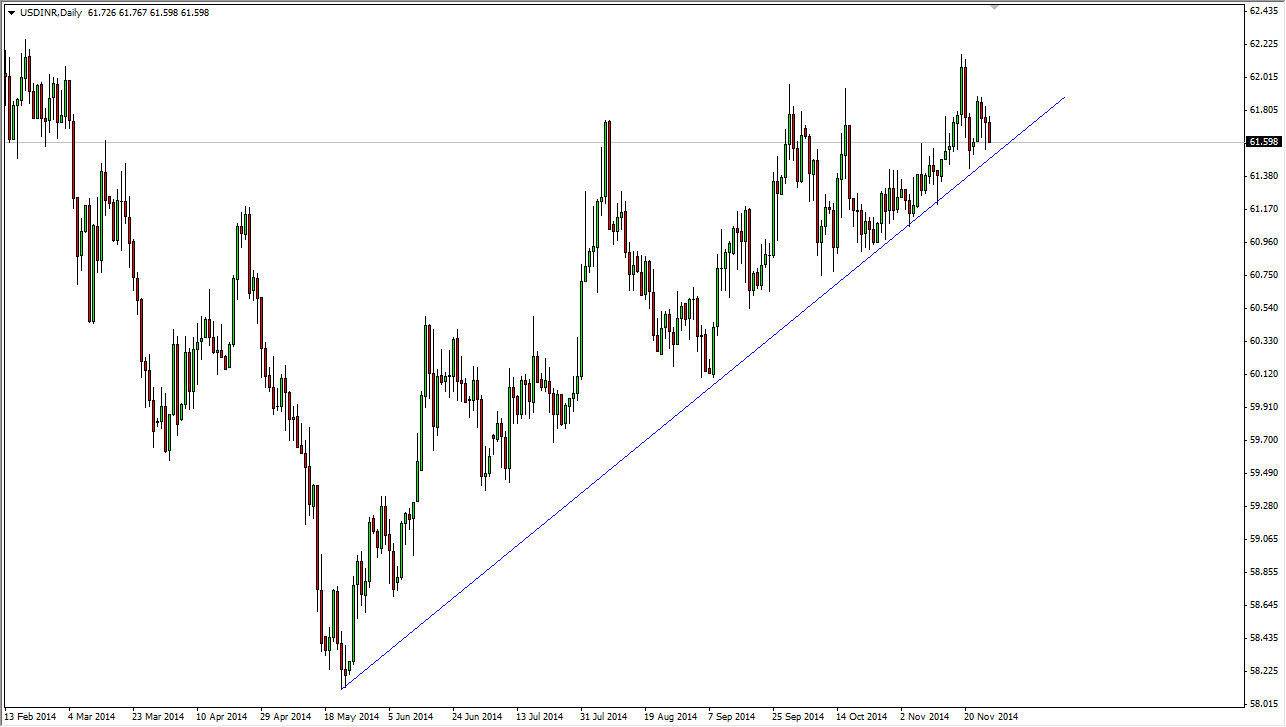

The USD/INR pair fell during the session on Thursday, as we continue to walk along the trend line higher. The market has been rather bullish but I am starting to be a little bit concerned about the trend. After all, it looks like the market is essentially tightening, and a trend line break it could be coming. Remember, this isn’t exactly the most liquid of pairs so moves can be very sudden and violent.

However, if you keep in mind that this is essentially a play on emerging markets. The Indian rupee is a currency that has a pretty decent interest-rate attached to it, especially when compared to the US dollar. However, we need to watch whether or not the trend line on the chart gets broken because that could be the beginning of a pretty significant move lower. I find it difficult to think that it’s going to happen, but I cannot help but notice that it is almost as if we are trying to figure out what to do. The action has been so erratic lately that it appears that some of the confidence seems to be failing.

Wait for the daily close

I’m going to keep watching this trend line, but I will wait for the daily close. We need to close significantly below it in order for me to think about shorting this pair, or we need to form some type of supportive daily candle such as a hammer in order for me to start buying. Perhaps he bullish engulfing candle would also work, but either way I need to see some type of movement that is significant and convincing. This is one of those times where certainly if you have to take a position it would be to the upside, but my confidence as an as high as it once was. On top of that, we are heading into the month of December which complete absolute havoc with the exotic pairs. However, if you have been long of this pair for some time like I have, you have made fairly decent profits.