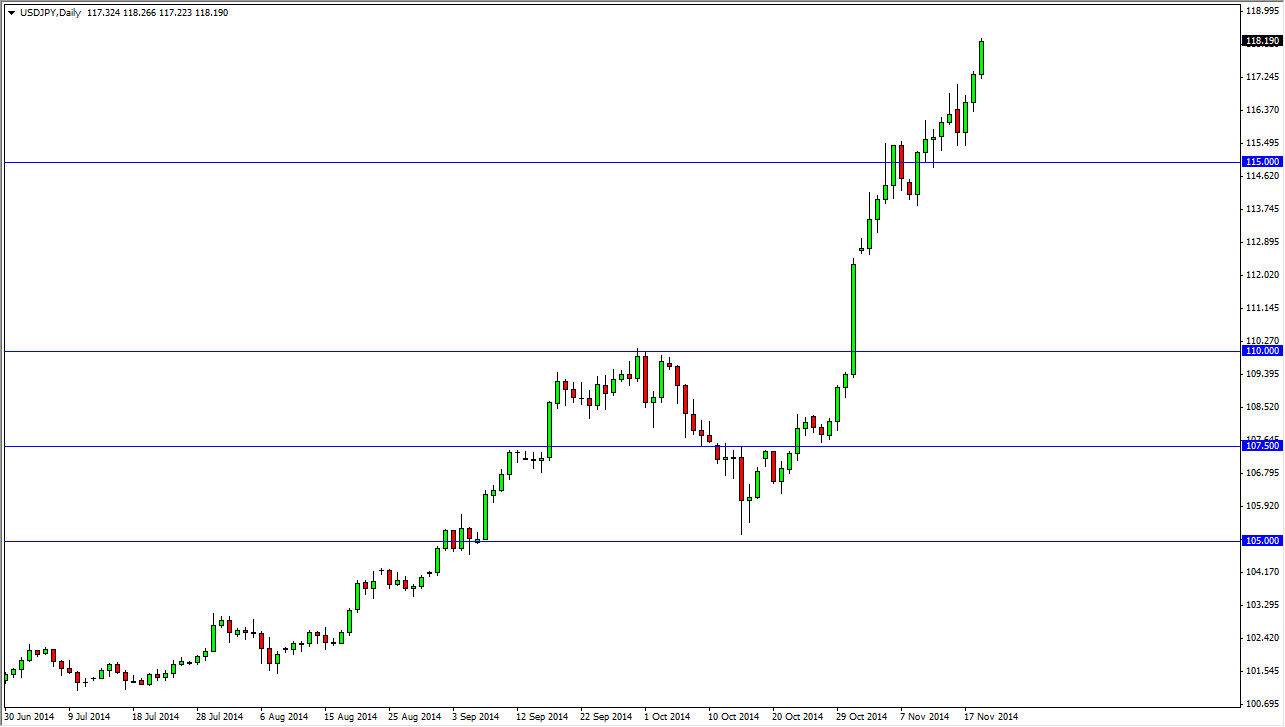

The USD/JPY pair broke out again during the session on Wednesday, as we continue to see you us dollar strength overall. In fact, it’s probably only a matter of time before we go to the 120 handle, which is my longer-term target. Quite frankly, we are higher than I anticipate being at this point in time during the year, and as a result this pair tends to be the “gift that keeps on giving.” Ultimately, the market should then struggle at the 120 level, but ultimately should break out above there as well. In fact, I believe that we are in a multi-year uptrend, so that every time this pair pulls back, I believe that it is an opportunity to pick up the US dollar based upon “value.”

The Japanese yen continues to get sold off against most currencies anyways, and with the US dollar being the strongest currency in the Forex world, it’s very difficult to sell this pair anyway. I believe that the 115 level below should be massively supportive, and essentially the “floor.”

Follow the trend, this is a career maker.

This is the type of trend that should make careers in my opinion. After all, the old “carry trade days” were as simple as buying this pair every time it dips. I think that it is going to be very similar going forward, as the Bank of Japan will continue to work against the value the Japanese yen overall. On top of that, the US dollar will be strengthened by the fact that the Federal Reserve has stepped out of the quantitative easing game.

As you can see, the market certainly has been parabolic lately, but we did have a little bit of a rest after the 115 level, so it makes sense that we would continue to go higher after catching our breath in that general vicinity. I have absolutely no interest whatsoever in selling this market, because I simply believe that pullbacks will make opportunities going forward for those of us that takes a longer-term perspective.