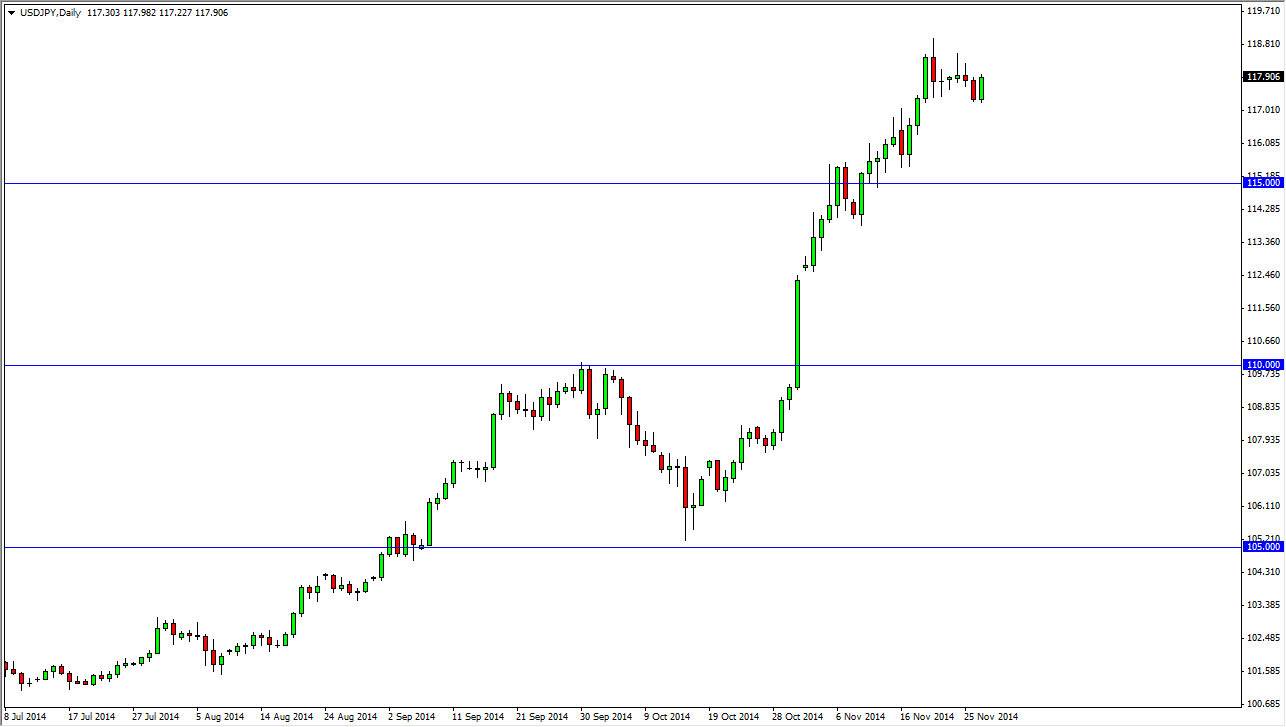

The USD/JPY pair rose during the Thursday session as we continue to see bullishness overall in this particular market. Keep in mind that Thursday was also Thanksgiving in the United States, so the liquidity would not have been as strong as usual. However, I don’t think that makes any difference as we have a significant amount of bullishness underneath, so I certainly wouldn’t argue with any positive movement at this point in time. The US dollar continues to be the strongest currency in the world right now, while the Japanese yen continues to be pummeled by not only traders, but actions of its own central bank. The Bank of Japan continues to do everything it can to bring down the value of the Yen, which of course helps the export market in Japan which is by far the largest engine of growth.

Don’t fight the trend

It’s almost impossible to fight this trend anyway, because it is so strong. The 115 level below should continue to bring in buyers, and I think the dips will represent “value” in the US dollar going forward, and that’s going to be true in almost every pair that the US dollars traded against. This will be especially true against the Japanese yen as it continues to get beat up against almost everything.

The pair is strong for a reason, and as a result I cannot see a reason to short it. The pair should continue to show strength overall, so that being the case I am buying it every time it dips as I think that this trend will last several years. I believe that we look at the 120 level between now and the end of the year, and continue going higher. However, keep in mind that we are going into the most volatile time at your typically due to a lack of liquidity, so it is possible that we get a rag movements. Nonetheless, this is a “buy-and-hold” proposition for me, so that being said I will always have at least somewhat of a long position in this particular market.