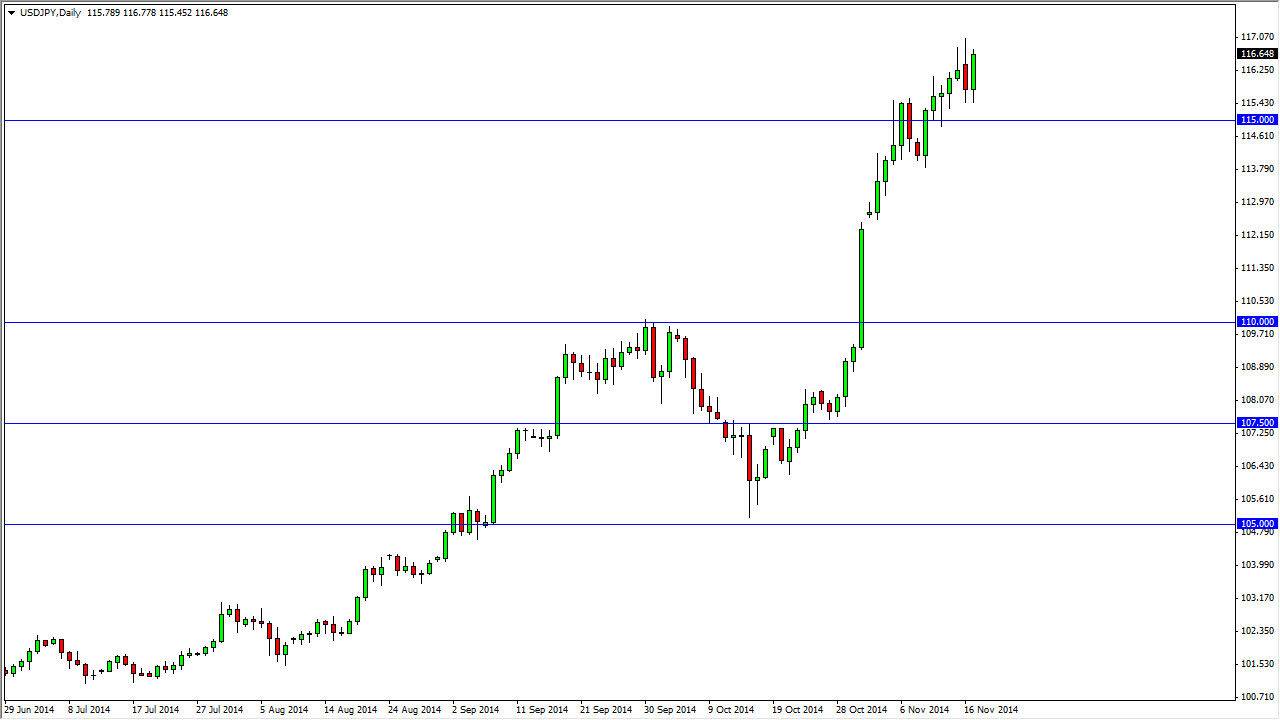

The USD/JPY pair broke higher during the course of the day on Monday, as we continue to see the 115 level offered a significant amount of support. That being the case, the market looks like it’s ready to continue going much higher, probably aiming for the 120 level given enough time. The US dollar of course is been boosted by the fact that the Federal Reserve is stepping away from the quantitative easing game, while the Bank of Japan continues to keep a very loose monetary policy. That being the case, it’s almost like a perfect scenario for a move much higher.

This is also a pair that tends to be somewhat risk sensitive, and as a result pay attention to the stock markets as they will often dictate whether or not we go higher as well. If the stock markets do well, typically this pair does also. Of course, the exact opposite is true as well.

I see massive support all the way down to 110

I see a significant amount of support all the way down to the 110 level. In fact, I find it almost impossible to short this market until we break down to at least that level, and probably even lower than that. I would be surprised to see this market even test the 110 level, as I see significant support at 115, 114, 112.50, and finally the aforementioned 110 level. Ultimately, I am looking at any pullback as “value” in the US dollar, and would buy supportive candles without any problem whatsoever. I believe that this is a longer-term “buy-and-hold” type of market, and therefore we should continue to see strength over the longer term.

I would not be surprise at all to see this market reach level such as 150 given a year or two, as this market does tend to trend for long periods of time. This looks a whole lot like it did back during the old “carry trade” days, which was a great time to make money in the Forex markets. With that, I expect big things out of this pair.