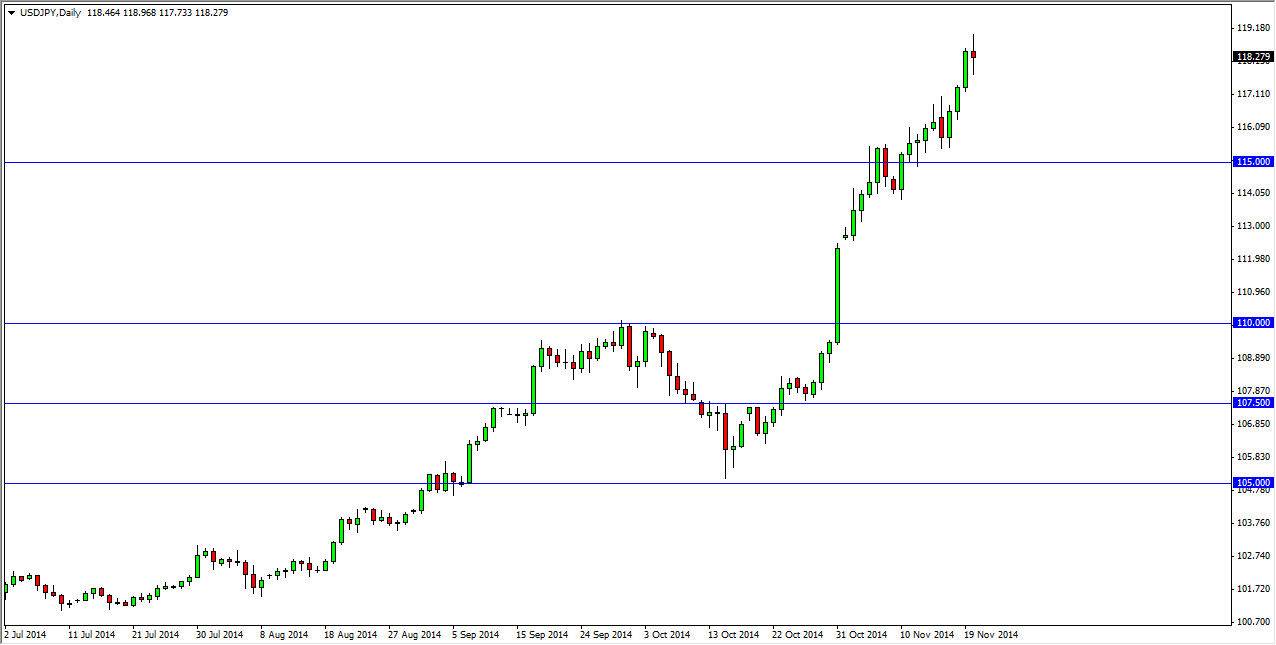

The USD/JPY pair continues to show strength even though we had a little bit of a neutral candle for the session on Thursday. After all, even though we are slowing down, it does in fact look like there are going to be buyers below. We think that there is massive support all the way down to the 115 level, and with that being the case I am looking for supportive candles in order to take advantage of value in the US dollar. I ultimately believe that this pair goes as high as the 120 level in the short-term, but there could be a bit of volatility between here and there. With very little in the way of economic announcements for the session on Friday, it would not surprise me at all to see this market kind of drift lower.

However, there’s absolutely no way to sell this market as a US dollars without a doubt the strongest currency out there, and it should be noted that the Bank of Japan is working against the value of the Japanese yen in general. I do not believe that this pair can break down below the 114 level, so that is essentially what I am calling the “floor” in this market.

Follow the trend it will lead to riches

If you follow the trend in this pair, I believe that eventually will make an absolute time of money. Buying on dips in adding to positions would be the way I truly plane this market going forward, probably for the next several years. This is the way this pair tends to act over the longer term anyway, so it makes sense as far as I can see continue to buy dips as they will represent value in the US dollar.

I really don’t see a scenario in which this pair melts down, like it did at the height of the financial crisis. On top of that, I don’t believe that this pair can break down. There’s just so much in the way of an order flow below that it’s almost impossible to imagine.