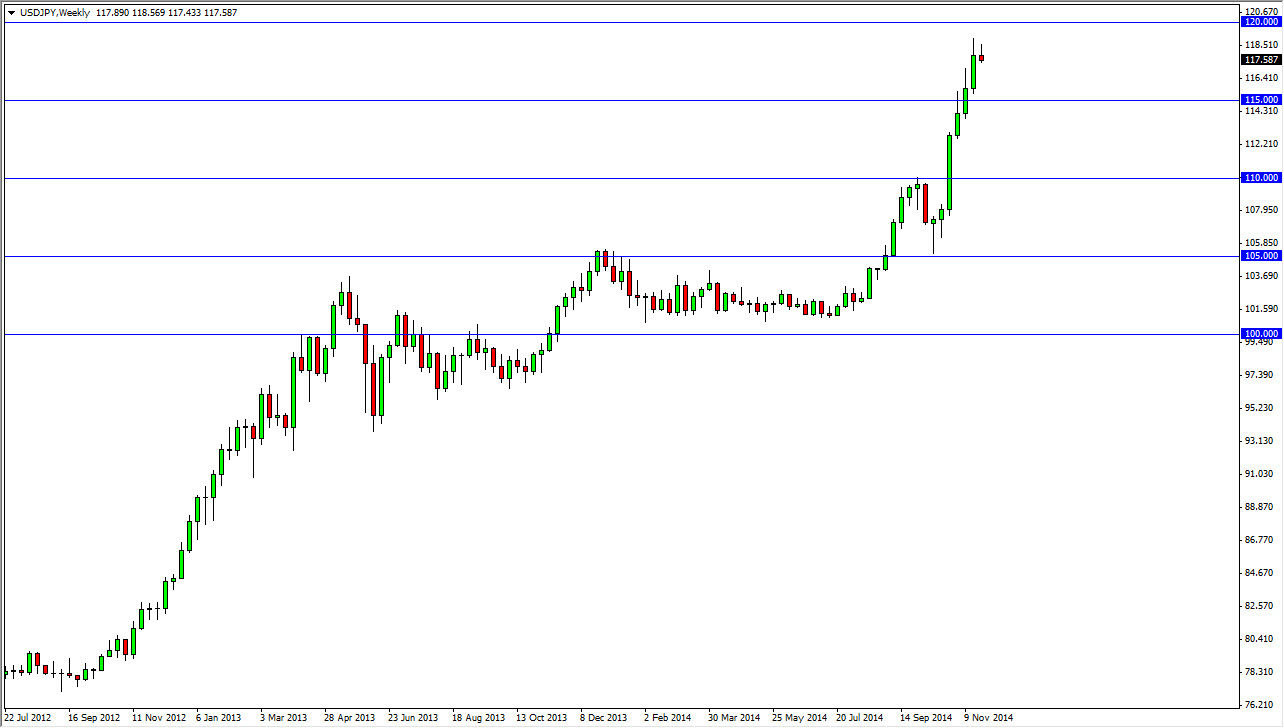

The USD/JPY pair has been astronomically parabolic recently, as the US dollar has just screamed higher in value. The Japanese yen on the other hand has been sold off drastically against most currencies, so this is made the USD/JPY pair extraordinarily profitable for those who would be long of the market, and one of the easier trades to take over the last several months. However, we are starting to go into the month of December and I think that we may get a little bit of a trend reversal coming.

Do not get me wrong - I have absolutely no interest in selling this market. I believe that now that we are heading into December, there are going to be money managers out there that are looking to bring home profits. Think of it this way: not all of your investments are going to do well, but if you managed to buy this pair at the break of the 100 level, you were sitting on pretty strong profits at this point in time. Those of profits that you can send back to your clients, which of course will think of you as a genius and therefore continue to pump money into your fund.

Follow the trend, but not till the end of the month.

If there’s ever been overextended market, this is it. I believe that the pullback will eventually be caught by the buyers, by it might not be until the end of the month. I would not be surprise at all to see this market go back down to the 110 level by the end of the month as there are so many profits to be had. I am going to be looking for a weekly supportive candle in order to reenter this marketplace and although I don’t anticipate seen any real strength until January, I am convinced enough about the upward momentum of this trend that I will enter if I get that signal before then. In the meantime though, I anticipate a lot of profit taking in this pair.