USD/JPY Signal Update

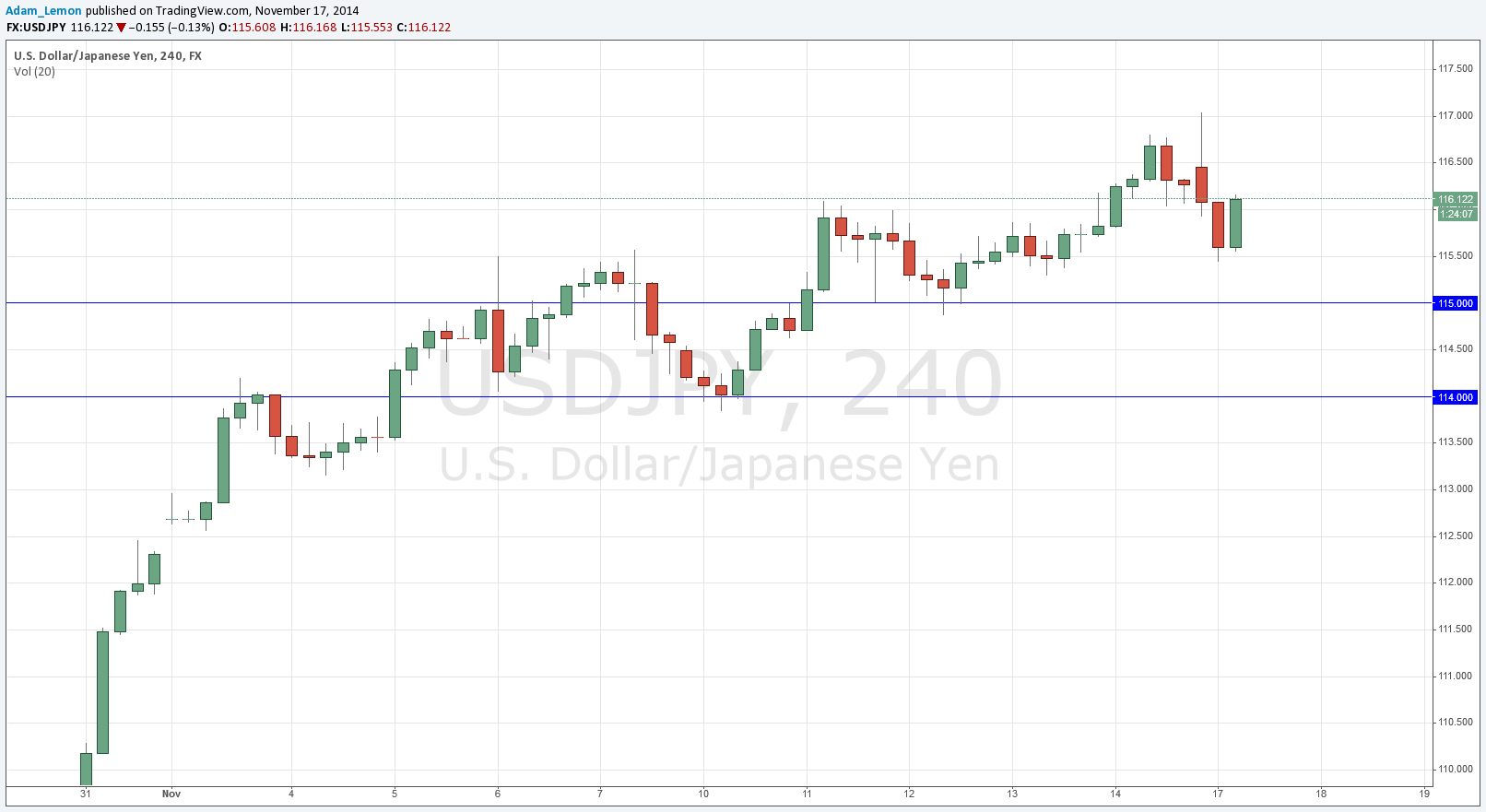

Last Thursday’s signal was not triggered as the price never reached 115.00.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be entered between 8am London time and 5pm New York time; and then from 8am Tokyo time.

Long Trade 1

Long entry following bullish price action on the H1 time frame immediately following the next touch of 115.00.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

Long entry following bullish price action on the H1 time frame immediately following the next touch of 114.00.

Place the stop loss 1 pip below the local swing low.

Move the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/JPY Analysis

Despite the relative slowdown that was seen last week in the rise of the USD, this pair continued to steam upwards due to continuing strong weakness in the JPY. We ended up making another multi-year high last Friday and in the Asian session last night another high of 117.00 was reached, since when the price fell quite heavily, before recovering again in the lead-up to the London open and also since London opened.

There is obvious resistance overhead at 117.90 but conditions are not right to think about shorting safely.

There is no obvious support before 115.00 and we probably will not reach that level today, but it could give a good long opportunity if and when it is reached.

There are no high-impact news releases scheduled today that are likely to affect either the JPY or the USD.