USD/JPY Signal Update

Last Thursday’s signal expired without being triggered as the price never reached 117.00.

Today’s USD/JPY Signal

Risk 0.75%

Trades may only be entered between 8am London time and 5pm New York time; and then after 8am Tokyo time.

Long Trade 1

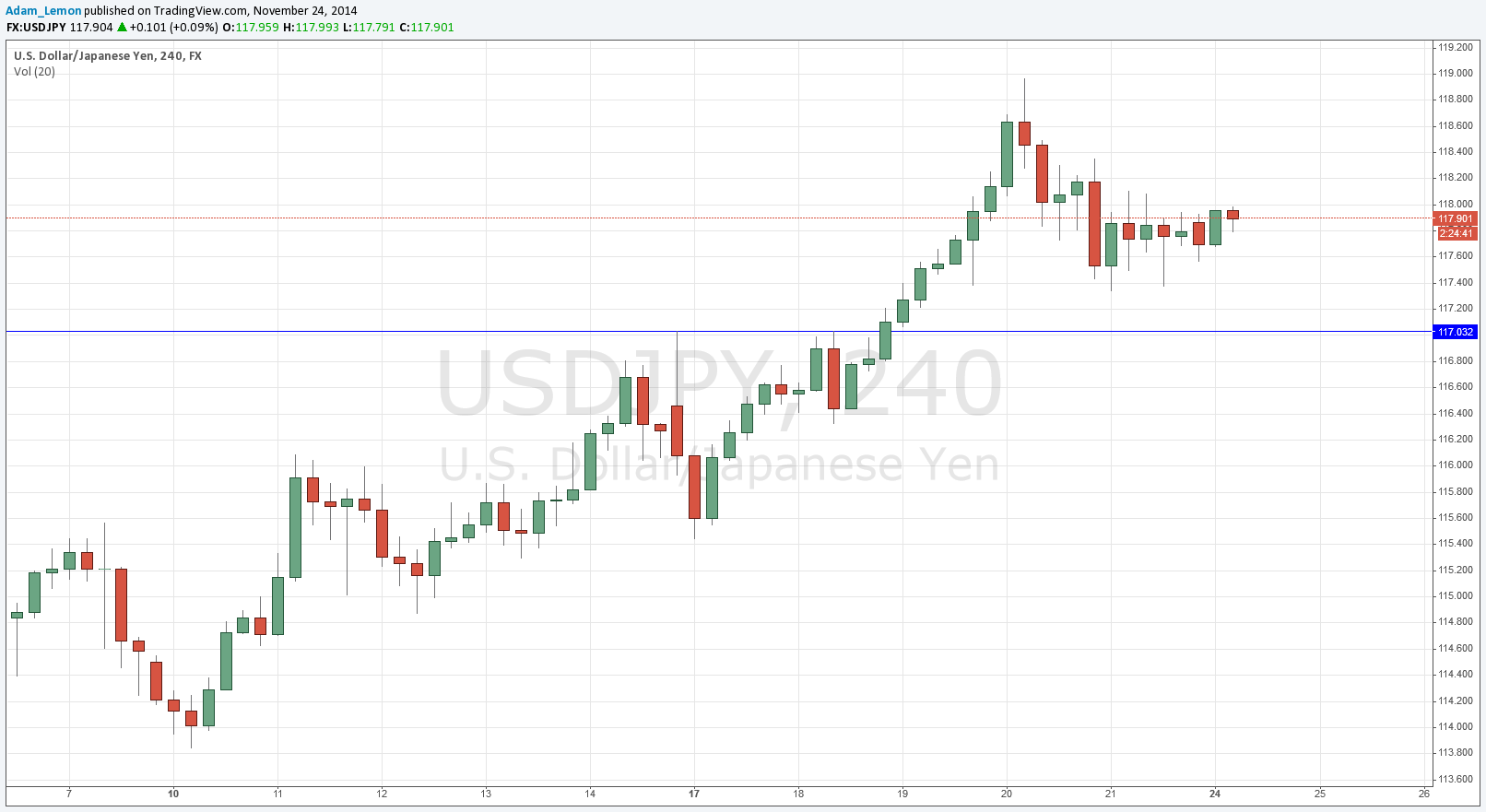

Go long following bullish price action on the H1 time frame immediately following the next touch of 117.03.

Put the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

We finally saw some bearishness in this pair last Thursday and Friday, as the price fell and could not bounce back very strongly at all, although it has formed some local support at around 117.40. This is something of a flipped level on the shorter time frames, but on the H4 time frame which is more secure the supportive level that really stands out is just above 117.00, which is both very close to a round number and a previously resistant double top.

There was strong selling at 119.00 but there is no reason to see that as an especially strong level. It is more likely that the psychologically key level of 120.00 will be harder to break than that.

There are no high-impact news releases scheduled today that will directly affect the USD. It is a public holiday in Japan so the pair might be fairly quiet during today’s London and New York sessions, but during the next Tokyo session (tonight London time), there will be a Speech and Press Conference by the Governor of the Bank of Japan, which may well generate volatility for this pair.