USD/JPY Signal Update

There is no outstanding signal.

Today’s USD/JPY Signal

No signal is given today.

USD/JPY Analysis

This pair has seen an absolutely meteoric rise over the past 3 weeks. It has risen almost 1,000 pips in 3 weeks! This is really quite shocking and something I think (without checking all the statistics) that we have not seen since the financial crisis of 2008/2009.

As this rise is so parabolic, trend-followers are likely to be sitting on very healthy profits, and feeling extremely tempted to take some or all of that profit, instead of waiting for that trailing stop of whatever type to be broken.

I will always recommend that a trader follows their system, and the JPY is certainly capable of remaining parabolic for a long time, so for all we know this pair could be at 120.00 next week.

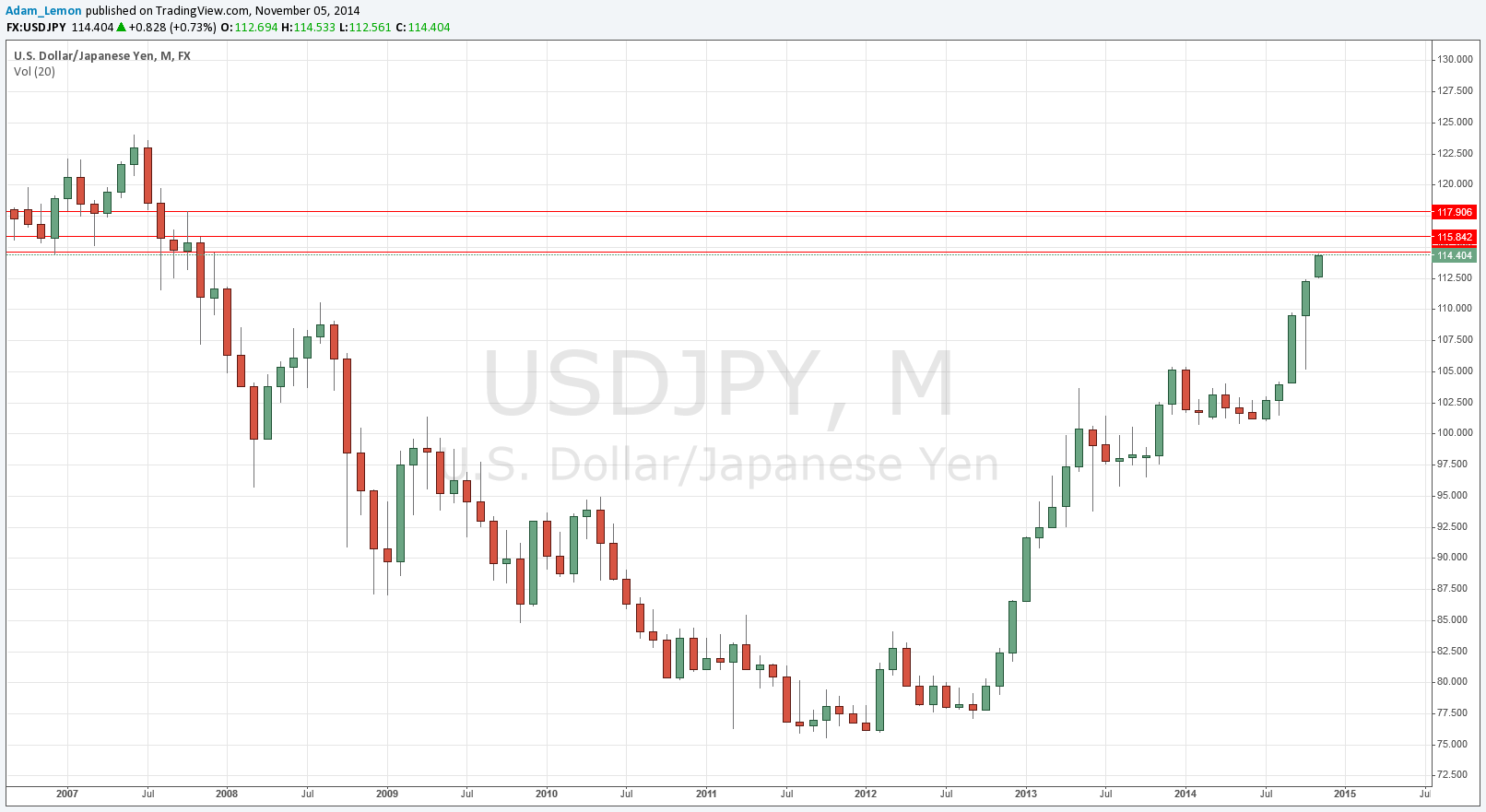

However, if you are thinking of taking some partial profit due to a fear that we are going to give back hundreds of pips – a fear which is statistically valid given the fact that we have already swung 1,000 pips up – you could do worse than zooming out to a monthly chart and taking a look at some key levels that might provide logical triggers for profit-taking.

There are certainly no obvious levels for entries after pull-backs before 112.50, and even that looks dubious.

Take a look at the monthly chart below. We are at a six year high. The first and closest level is the monthly swing high at 114.65 from December 2007. We have got to within 12 pips of that level. If this level is broken easily, that would be a sign that we have further to go. Not far beyond this level is the psychological round number of 115.00. It is the combination of these two levels in proximity that convinces me the area is likely to act as a barrier, at least for a while.

Beyond this area, there is a great flipped level at 117.90, which could be a good longer-term target.

I don’t see any good long entries before 112.50 and I would not be prepared to go short yet, even from the 115.00 area.

At 1:15pm there will be a release of U.S. ADP Non-Farm Employment Change data, followed later at 3pm by ISM Non-Manufacturing PMI data, both of which are likely to have a strong impact on the USD. There are no high-impact news events scheduled today that are likely to directly affect the JPY.