USD/JPY Signal Update

There is no outstanding signal.

Today’s USD/JPY Signal

No signal is given today.

USD/JPY Analysis

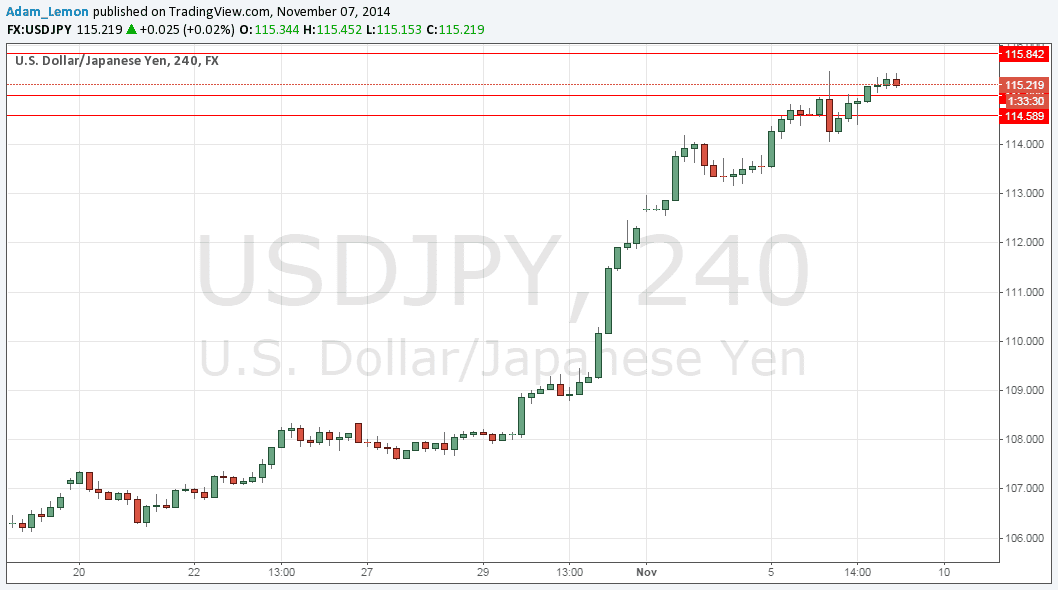

Two days ago I wrote about the metoeric rise that this pair has undergone in recent weeks. While it is always dangerous to try to pick tops and bottoms, especially in extremely strong trends such as this one, when a move of 1,000 pips occurs in only 3 weeks one has to ask how much further it will go before some kind of pull back occurs.

Therefore I did pick a few key levels to watch out for:

A monthly swing high at 114.65 from December 2007. This was broken easily and did not really even act as resistance, so this level can be discounted, especially if this week's close is above that level. I had seen that an easy break of this level would be a bullish sign, and we did in fact reach 115.50.

The key psychological level at 115.00. When this level was reached there was a sudden drop with a bearish reversal type of candlestick, as shown below on the H4 chart. However, there was not a sudden reversal, but instead a continuing rise after that very brief pull back. What will be a key indicator is whether we manage to breach the high of 115.51 that we made earlier this week, and whether the price closes the week later today clearly above the 115.00 level. If these events take place, it is likely to be a bullish sign.

There is an as yet untested monthly level at 115.84 which has not been reached yet. It might provide a level for the start of a reversal or pull back.

I also mentioned a much higher level at 117.90, but we still have some way to go beore this comes into play.

I still do not see any good long entries before 112.50 and I would not be prepared to go short yet, even from the 115.84 area.

At 1:30pm London time there will be a release of U.S. Non-Farm Payrolls data, followed later at 5pm by a speech from the Chair of the Federal Reserve, both of which are likely to have a strong impact on the USD. There are no high-impact news events scheduled today that are likely to directly affect the JPY.