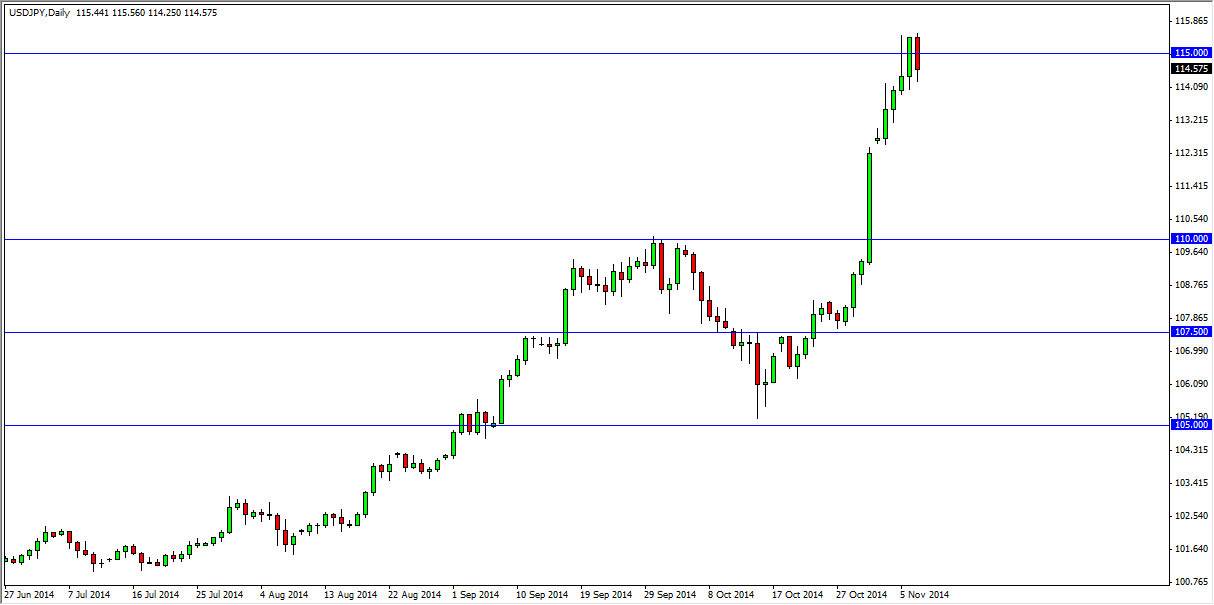

The USD/JPY pair fell back a little bit during the session on Friday as the 115 level offered enough resistance to force the market a little bit lower. That being the case, the market should continue to pull back from this area, but I believe that there is plenty of support below in order to find buying opportunities. I think it’s obvious that the US dollar is the most favored currency by Forex traders around the world, and the Japanese yen of course is being sold off drastically. With that being the case, there’s no sense in trying to make countertrend trades and sell this market. I believe that it’s easier to simply wait for the supportive candles so that we can take advantage of the obvious bullishness and switch and momentum that we have seen in this market for some time now.

Central banks

There are diametrically opposing views as far as monetary policies are concerned in this market. The US dollar should continue to strengthen based upon the fact that the Federal Reserve has left the quantitative easing game. It’s not that we are ready to continue higher based upon any interest-rate moves, other than the slight uptick in value as far as bonds are concerned. The Federal Reserve is nowhere near raising rates, but they are still quite a bit closer than the Bank of Japan. In fact, I fully anticipate that the Bank of Japan will probably do more and more to loosen monetary policy and bring down the value of the Japanese yen overall.

Because of this, this is essentially a “buy only” type of market, and then I think that every time we pullback the market will recognize the inherent value in the US dollar as I would anticipate this market moving higher on the course of several years, and that we are most certainly in a long-term uptrend, but of course there will be volatility. Look at volatility as potential buying opportunities as the market will inevitably pullback from time to time. Selling isn’t even a thought.