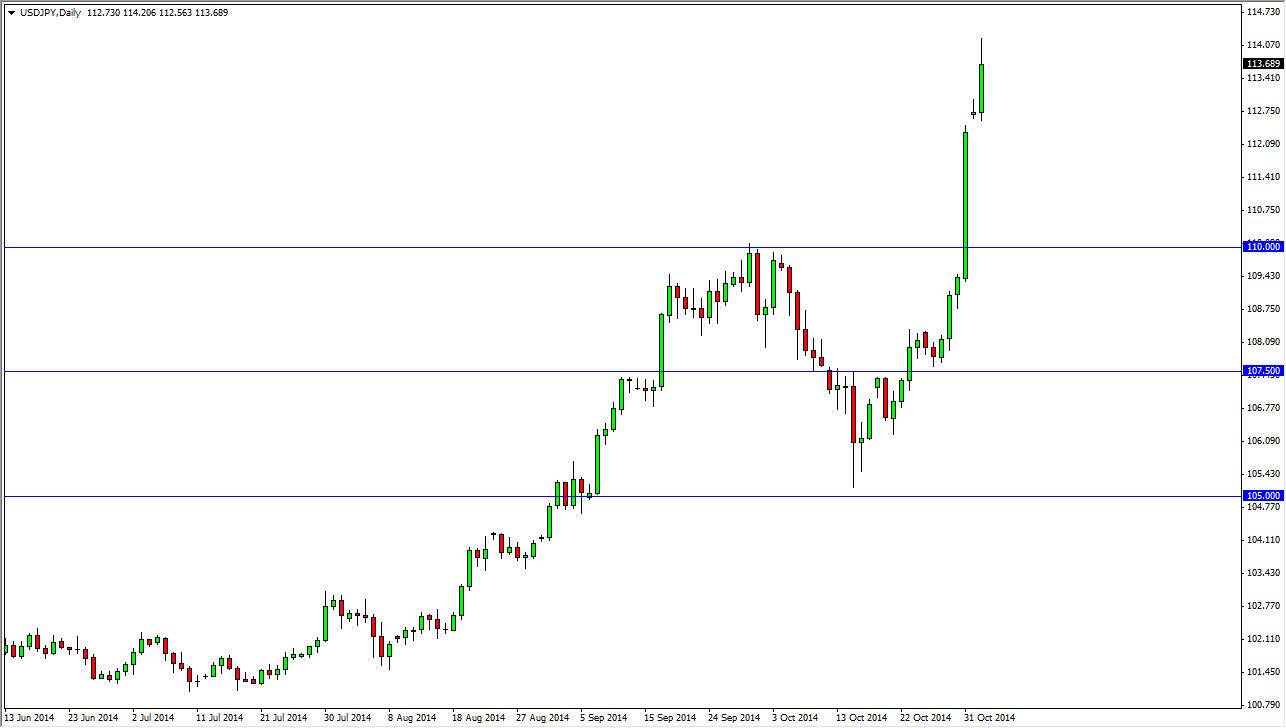

The USD/JPY pair took off during the session on Monday again, as this market just simply cannot go higher now for the buyers. After all, the Bank of Japan has reiterated its desire to stay in the quantitative easing game, thereby giving a lot of strength to US dollar bulls when it comes to this particular market. Ultimately, it’s very likely that this pair will reach the 115 level, and even higher than that given enough time. In fact, I once had a target of 115 by the end of the year, but that could be seen in the next couple of sessions!

Don’t get me wrong, I wouldn’t be entering this market to the upside at this level. I think we have certainly gotten oversold at this point, and pullbacks would be welcome opportunities to buy a US dollar “on sale.” I think that the 110 level now will act as the “floor” in this market, as it was the site of such a significant breakout to the upside. It’s likely that pullbacks will continue to be looked at as buying opportunities by most of the marketplace. Because of this, I feel that we are still in the “buy on the dips” mentality that we have been in for some time. I have no interest in selling this market, and I believe that ultimately we could go even higher than 115 between now and the end of the year.

Think of things as being “on sale.”

A lot of traders don’t understand that in an uptrend, when the market pulls back the leading currency is actually “on sale.” In other words, it’s cheaper than it normally is or should be. That’s how you have to look at this market, as it seems like we will be going too much loftier levels over the longer term. It doesn’t mean that you always want to be long of the market, just that you never want to be short of it. Supportive candles below will continue to be far too tempting for the buyers to ignore.