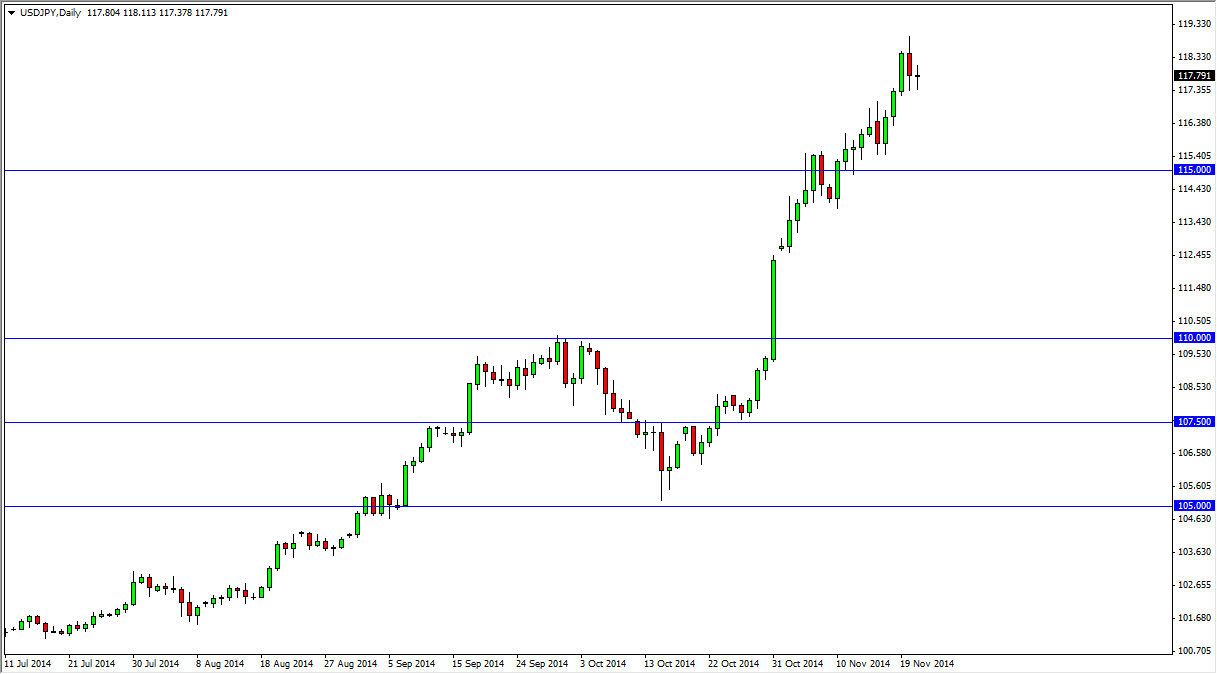

The USD/JPY pair did very little during the session on Friday as the market took a rest. We are currently testing the 118 level, and as a result it would make a lot of sense if we pull back slightly in this general vicinity as far as I can see. I think that the 115 level below will continue to be massively supportive, so I am willing to buy pullbacks all the way down to that level that show signs of support. We have changed the attitude of this market over the last several months, and it is without a doubt one of the most bullish Forex pairs that I follow.

I think that the continued theme of Japanese yen selling will continue going into 2015, and therefore there’s no reason whatsoever to sell this market. Doing so would go against what is obviously the theme of Forex markets at the moment, US dollar strength. Coupling that with a Bank of Japan that is more than willing to do whatever it can to bring down the value of its own currency is probably one of the better trades out there right now.

Think of value

Every time this market pulls back, you need to start thinking about value. In other words, US dollar is going “on sale.” It’s essentially like trying to buy anything else, there are times when you get a better deal than others. I think that’s what pullbacks represent in this marketplace, and I see massive support all the way down to the 110 level. I don’t see is going below there at all, and quite frankly I would be surprised to see this market move below the 114 level between now and spring. However, I recognize that anything is possible.

I think that ultimately we go to the 120 level, and it could very well happen in the next couple of weeks. At that point in time, I would anticipate a pullback that should bring in more buyers towards the end of the year or perhaps even the beginning of next year. I buy on dips, and that’s it.