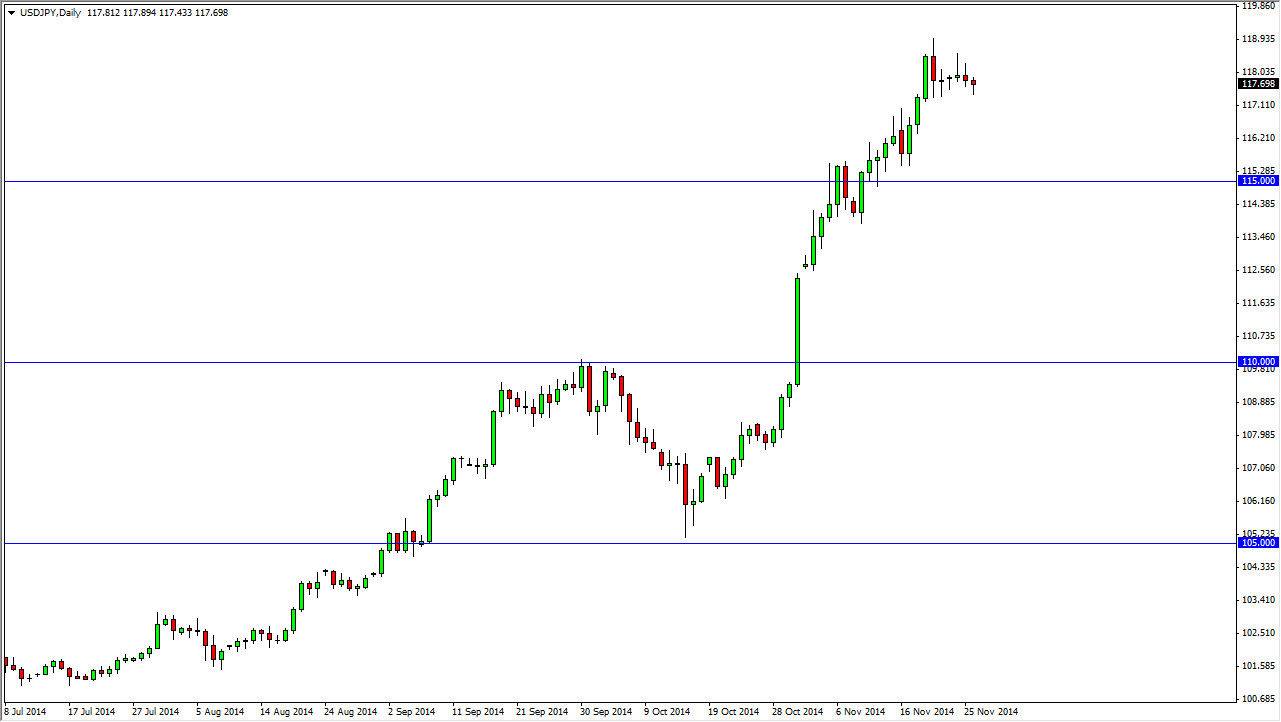

The USD/JPY pair fell slightly during the course of the session on Wednesday, but at this point in time it looks as if the market is simply ready to go sideways. With today being Thanksgiving in the United States, the likelihood of the market moving drastically is probably slam. However, if we do make a move I believe it will more than likely be a pullback to the 115 level. That’s an area where would anticipate seeing buying opportunities, as it was an area that was so resistive previously, and as a result should now be supportive.

I believe that this market goes to the 120 level, but it’s going to take a bit of time. Every time this market pulls back there will be buyers willing to step in as the US dollar is the favored currency by most Forex traders around the world, and of course the Japanese yen is been worked against buying the Bank of Japan currently.

One direction only

This is a market that can only be traded in one direction as far as I can see, as the buyers most certainly have control of this pair. Any pullback at this point in time should be a nice buying opportunity as the truth of the matter is that the central banks are working in concert to move this pair higher as the US dollar will continue to strengthen due to the fact that the Federal Reserve has step away from quantitative easing. The Bank of Japan of course continues to keep its monetary policy extraordinarily loose, and could even add to it. With that being the case we feel that the market will continue to punish the Japanese yen in general.

Ultimately, this is a longer-term buy-and-hold type of situation as far as I can tell, and that’s exactly how on going to treat it. Every time this market dips, we should see buying pressure going forward as the market continues to offer buying opportunities every time we pullback in order to suggest value in the US dollar going forward.