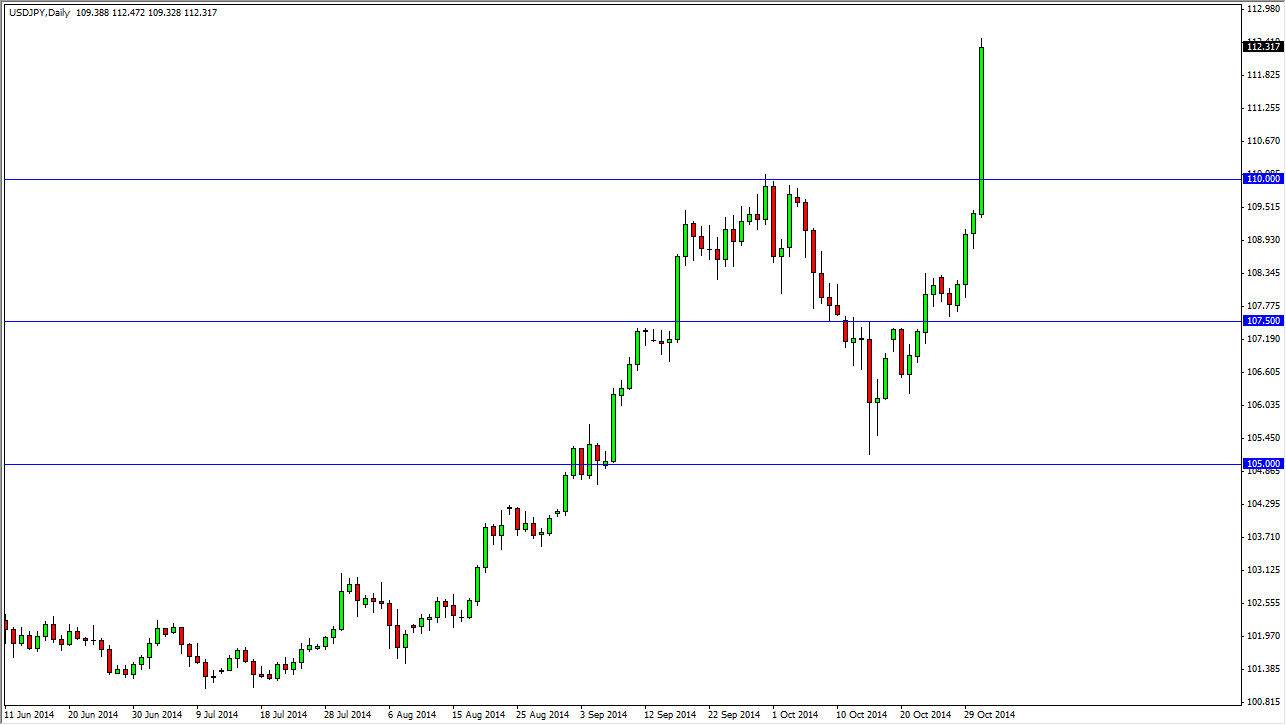

The USD/JPY pair broke out during the session on Friday, smashing through the 110 barrier. This is an area that has been massively resistive in the past, so it makes a lot of sense that this would have attracted a lot of buying once we saw the bullish move. It now appears according to the Bank of Japan that they are more than willing to support the Nikkei and do what they can to keep the value of the Yen low. With the monetary policy out of Tokyo continuing to be extraordinarily soft, the market should continue to see the US dollar continued to climb against the Japanese yen, as the central banks are moving in a divergent manner.

Longer-term trend

I believe that this market is continuing a longer-term trend that could see the USD/JPY pair go to much higher levels. I think that the 115 level almost certainly be hit fairly soon, and I have had it as an end-of-the-year target for some time, but I’m afraid that might have been a little bit short of where we end up. Nonetheless, I think that the longer-term trend will continue, and we are now in a marketplace that is essentially as easy as selling the Yen every time it gains strength.

I believe the traders will continue to “buy on the dips” as we continue to grind much higher. This is very reminiscent of the way the Japanese yen traded several years ago before the financial crisis, as the carry trade was in full effect. This is a necessarily the carry trade coming back from the dead, but it does ask much like it. I believe that you can continue to buy this market again and again and perhaps some of the other yen related markets against currencies it will actually pay a positive swap. I see no reason to sell this market, and I believe that any pullback towards the 110 level should have plenty of support as it was the site of such a significant breakout.