USD/CAD

The USD/CAD pair tried to rally during the course of the week, but you see it did run into a bit of trouble above. Because of this, we formed a shooting star, and it appears of the 1.15 level is going to be rather resistive. That’s not a big surprise though, as it is a large, round, psychologically significant number. The shape of the shooting star suggests that the market is probably going to drop from here, but ultimately I think that there is plenty of support below that could get this market going higher. With that being the case, I am still bullish but we are looking for a pullback in order to take advantage of value in the Dollar.

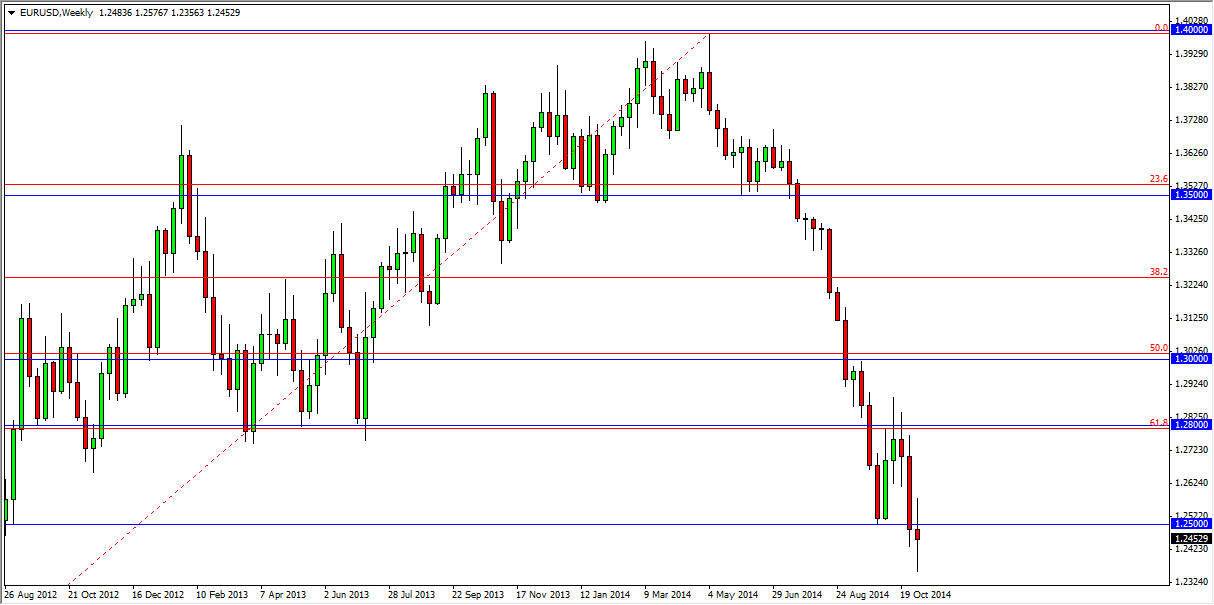

EUR/USD

The EUR/USD pair had a very volatile week, hovering just below the 1.25 handle. I believe that this market is going lower, but there might be a bit of volatility to be had in this area. The girls, I am still selling this market as I believe the longer-term move is going to head to the 1.2050 level. That was the beginning of the move higher from several months ago, so we are simply going to do a “round-trip” in my opinion.

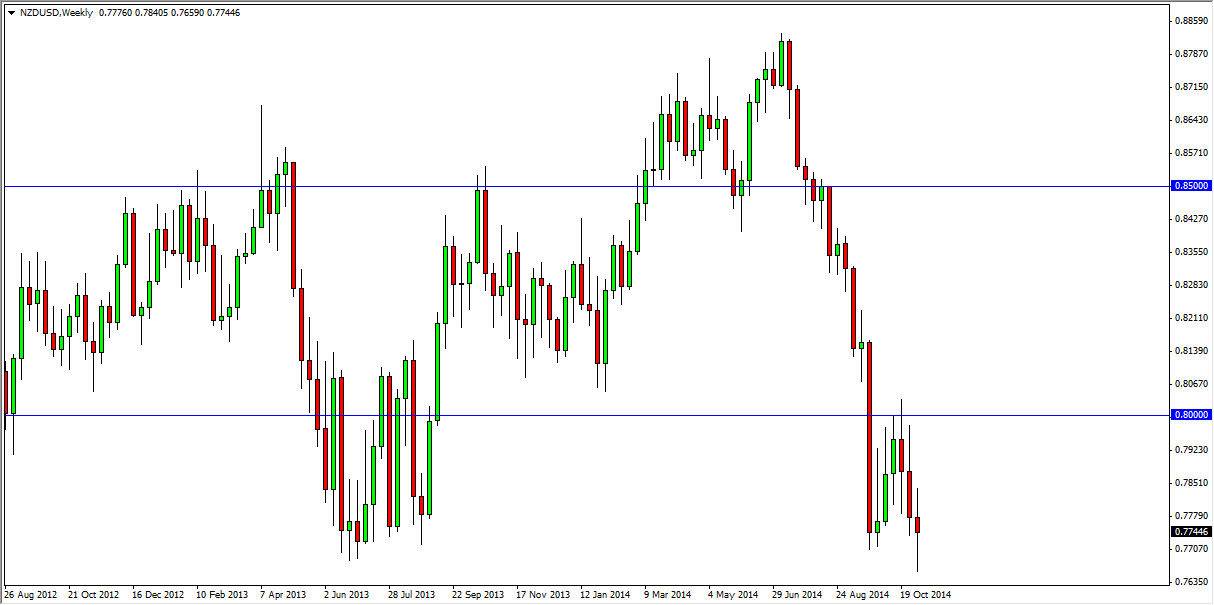

NZD/USD

The NZD/USD pair went back and forth during the week as well, as we continue to test the waters just below the 0.77 handle. I believe that this market continues to go lower given enough time, but we could get a bit of volatility between here and there. Remember, the Royal Bank of New Zealand continues to want this pair to go lower, and has even mentioned a target of 0.68 against the dollar. With that, I believe that the market continues to drop lower from here, and it’s only a matter of time or we break down. I am a seller.

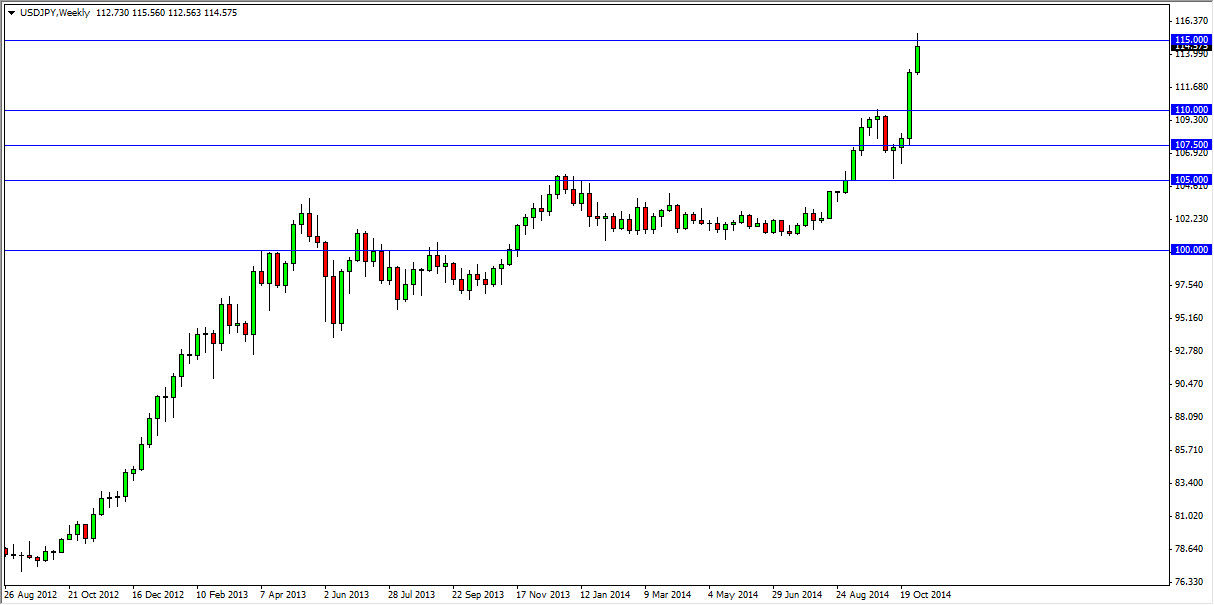

USD/JPY

The USD/JPY pair broke to the upside during the week, but ran into a bit of trouble at the 115 level. That’s not a big surprise to me, as it is a large round number, but ultimately I believe that we do probably see a little bit of a pullback but I also look at that as potential value in the US dollar. I am buying pullbacks to that show signs of support.