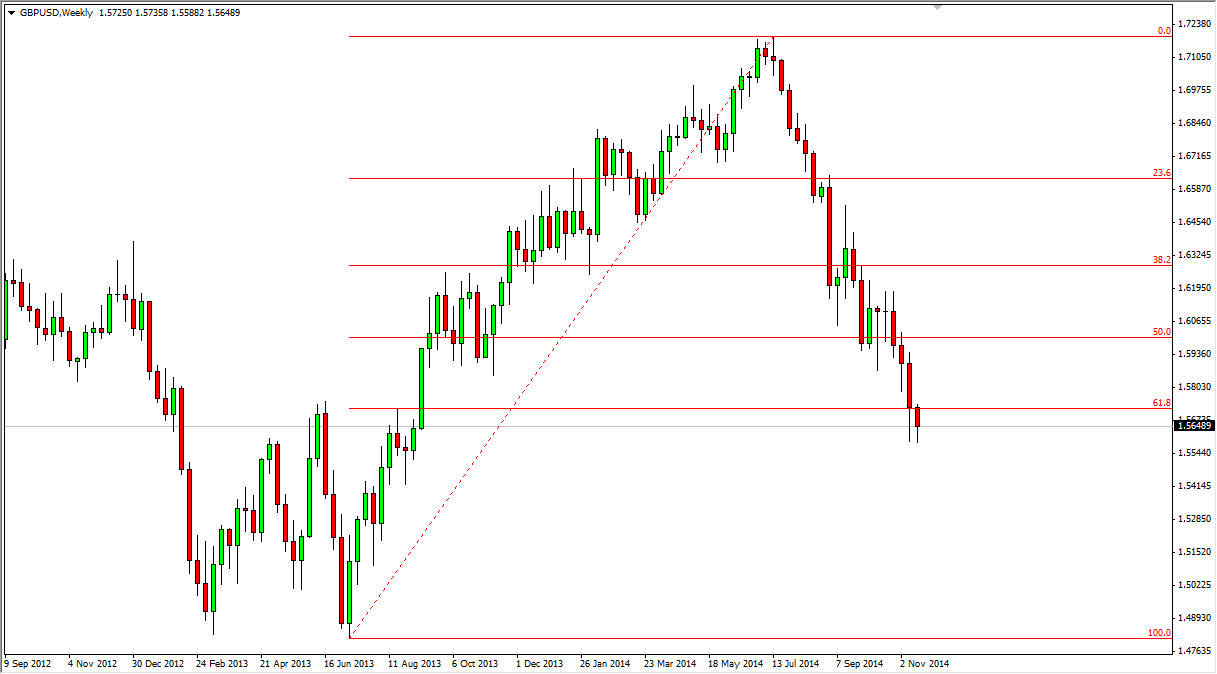

GBP/USD

The GBP/USD pair fell during the course of the week, but as you can see found a little bit of support towards the later part of the candle. However, what has caught my attention is that there is a lot of noise below here, so we may need to bounce a little bit in order to continue going lower. With that, I am a bit bearish of this market but also cognizant of the fact that we may get a little bit of a relief rally. On the other hand, if we broke down below the bottom of the candle I would have to assume that we are to simply going to continue going lower.

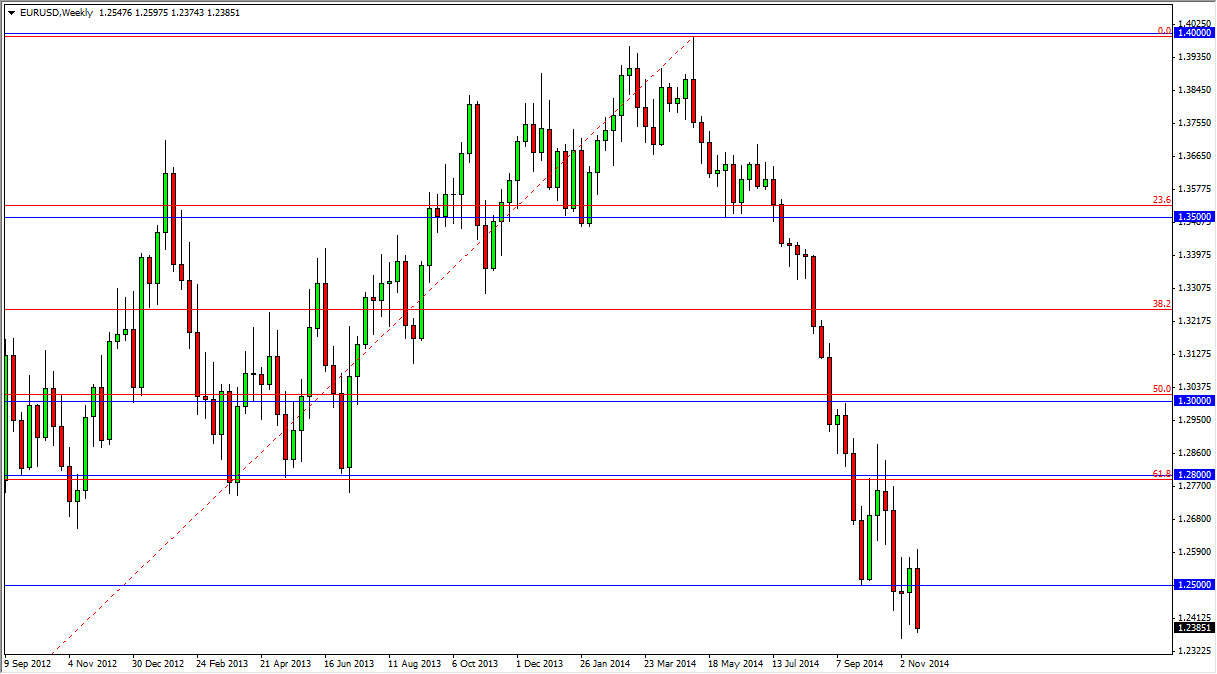

EUR/USD

This pair continues to fall, and although we did not break down for a fresh, new low, I cannot help but notice that we are at a fresh, new closing low which is almost the same thing. Because of this, I believe that the pair will continue to be one that you can sell going forward, and rallies just simply represent value in the US dollar. Ultimately, I still think we go down to the 1.2050 area, but of course that’s going to take some time.

EUR/GBP

In a continuing theme, the Euro looks horrible in this pair as well. Granted, we are still within the consolidation area but I recognize of the Euro has much more in the way of problems than the Pound. The candle certainly suggests the same thing as well, as we have proven the 0.8050 level to be resistive enough to turn the market back around and keep the sellers in control. With that, I believe that this market makes a move towards the 0.7750 level over the course of the next couple of weeks.

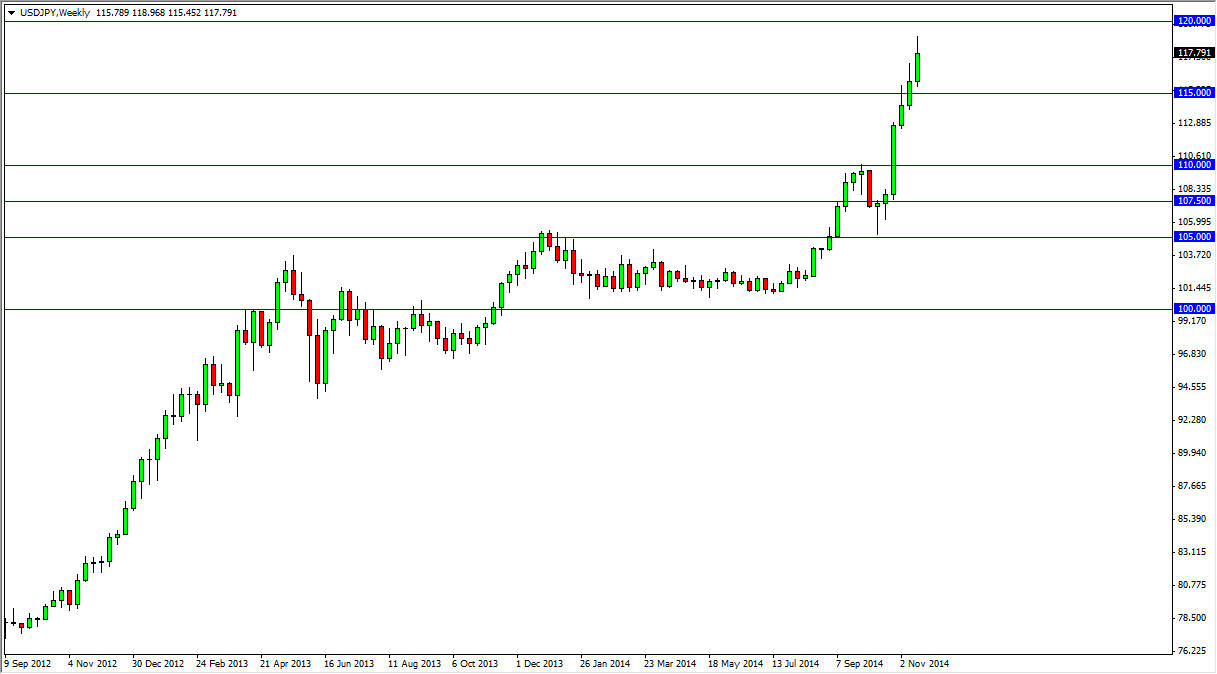

USD/JPY

Unless you are completely blind, there’s no way to think that you can do anything but by this pair. This is probably one of the easiest markets to analyze at the moment, because it is so one-sided. Pullbacks represent value and although we could get one fairly soon, I still believe that every time this pair drops a few hundred pips, you should essentially “load the boat” with US dollars. I will continue to buy this pair over and over again for the next several years.