By: Stephanie Brown

CBS Corporation (NYSE:CBS) and Walt Disney Co. (NYSE:DIS) have gone to court to block the disclosure of programming contracts as part of the ongoing review concerning merger deals in the U.S. The two companies argue that a possible leak of some of the sensitive information may jeopardize their competitive advantage in the media space.

There has been an ongoing standoff as to who is entitled to view some of the sealed documents, with DISH Network Corp (NASDAQ:DISH) maintaining it needs to analyze them in order to inform the FCC. Dish Network already took a hard stance against the impending merger between Time Warner Cable Inc. (NYSE:TWC) and Comcast Corporation (NASDAQ:CMCSA), arguing it will only dent the spirit of competition.

CBS and Walt Disney argue that allowing parties like Dish to view some of the contracts will affect their negotiation concerning distribution agreements, which may result in substantial harm. The Federal Communications Commission always recognized that distribution agreements should at all times be given the highest level of confidential treatment.

Joining CBS and Walt Disney in their quest to block the release of some of the contracts include Twenty-First Century Fox Inc. (NASDAQ:FOXA) and Time Warner. Many of the content providers are currently reviewing their contract agreements with the Colorado-based Dish and believe any disclosure of the contracts will considerably affect their negotiation advantage. The FCC was forced in October to suspend the informal review of the Comcast AT&T Inc. (NYSE:T) merger as it sought to find a solution on the stand-off over the contracts.

Some of the details that CBS and Disney do not want third parties to see include the prices charged on carrying channels as well as guidelines for making content available online. The documents are to be released on Thursday unless of course the court sides with media companies.

Technical Analysis

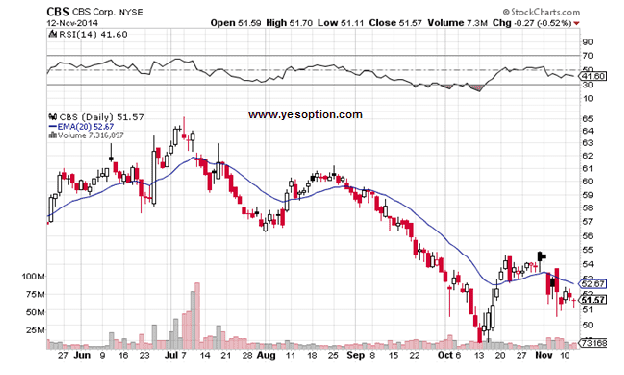

CBS, after rallying until $55 couldn’t sustain itself at that level and has since been plummeting. The stock was down marginally in yesterday’s trading session, and closed at $51.57. It is currently trading way below its 20-Day EMA of 52.67, with its RSI additionally trending down. Going forward the stock has support near $50 and $49, with resistance on the upside near the $52.5 and $53 levels.

Actionable Insight:

Short CBS Corporation (NYSE:CBS) below $51.4 for target of $51.2 and $50.9, with stop-loss of $51.5