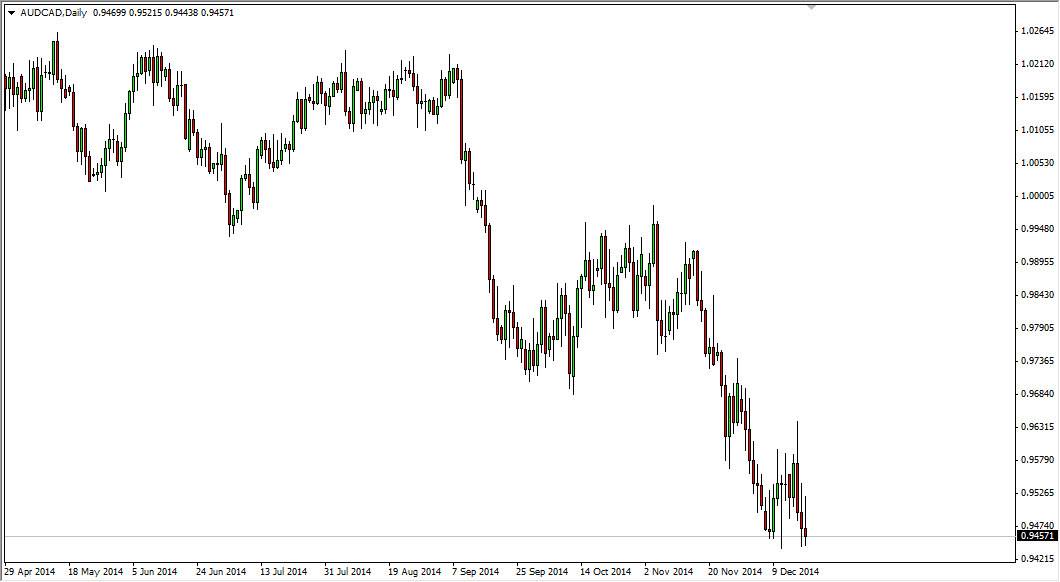

The AUD/CAD pair initially tried to rally during the session on Thursday, but as you can see sold off yet again. This is a market that seems to be hell-bent on breaking down, and as it mimics the NZD/CAD pair, and that one looks very vulnerable at the moment, it makes sense of this pair would continue to drop. The 0.94 level looks like it’s ready to continue to break down, and just as the NZD/CAD pair, I believe that this is a “Pacific versus North America” type of trade.

On top of that, the Australian dollar is highly leveraged to the gold markets, and as a result I believe that the weakness in the gold market should continue to weigh against the value of the Australian dollar. On top of that, the oil markets will find support before the gold market in my opinion, so it’s only a matter of time before we get a little more bearish pressure in this market.

Follow the trend, as usual.

Almost always follow the trend anyway, but the fact that we formed a shooting star just above support tells me that the buyers couldn’t even pick up the market from there. I think that even if we broke higher from here, the 0.96 level will be targeted for resistance. It’s only a matter of time before the sellers would step been at that point in time, and with that I am continuing my bearish stance in this market.

This market does look a bit oversold at the moment, but at the end of the day the trend is strong and with a good reason. Ultimately, I think that we probably head to the 0.90 handle, and possibly even lower than that as the Australian dollar is so negative at the moment. With that being the case, I’m selling rallies, and most certainly selling breakdowns. That being the case, I have no scenario in which am a buyer of this market as I believe that there is a massive ceiling in this market out the 0.96 handle.