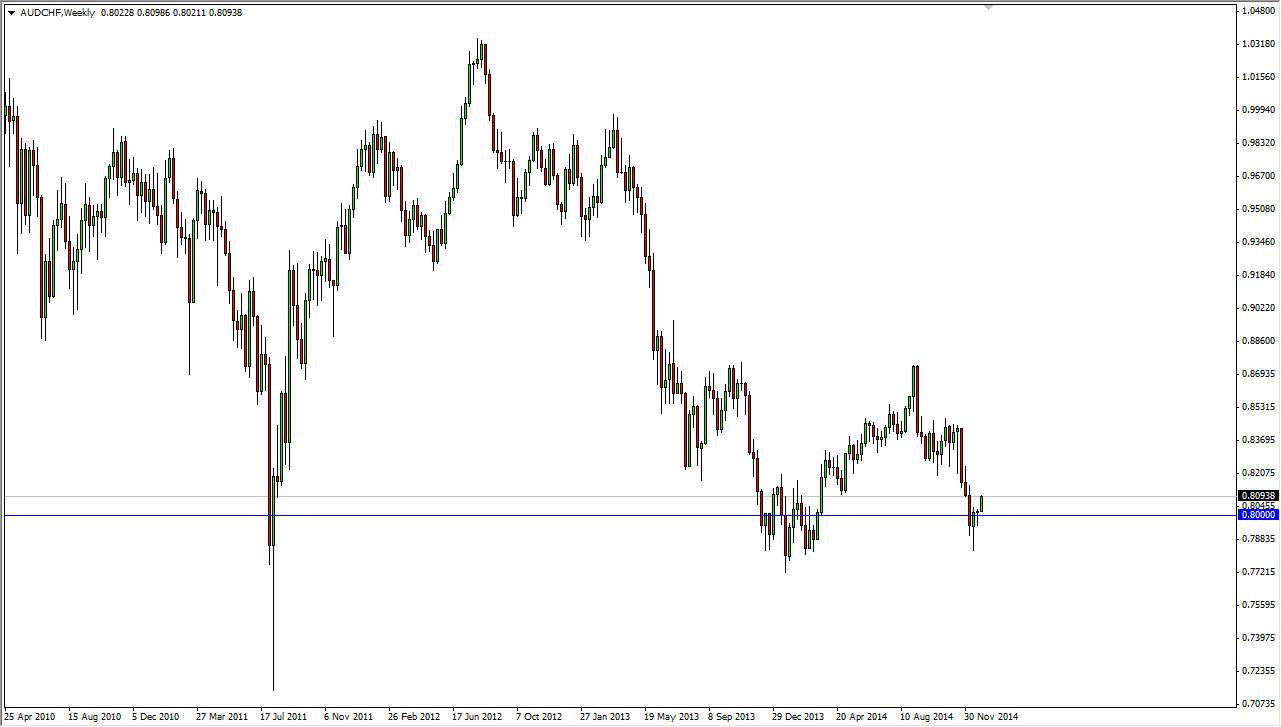

The AUD/CHF pair will be one that’s worth watching during the month of January. The thing I like about this pair is that it essentially shows the risk appetite of the world. The Australian dollar of course does better as the risk appetite grows, and of course the Swiss franc appreciate in value when people are a bit more concerned. The truth of the matter is that this pair has fallen rather hard but it looks like we are forming some type of double bottom near the 0.80 handle.

This is interesting to me because I believe that the Australian dollar is starting to form a little bit of a support area against the US dollar. With that being the case, I believe that the Australian dollar is trying to finally get its feedback, which means that we should start to see appreciation in the Aussie towards the end of the month.

Longer-term possibilities

There is a possible longer-term play showing up rain now. This comes down to whether or not you can hang onto the Australian dollar over the longer term, as the interest-rate differential will favor you of course. Ultimately, I believe that we could go as high as 0.88 level course of the next couple of months. It’s not going to be an easy move obviously, but ultimately I believe that the Australian dollar has sold off about as much as it needs to.

The Swiss franc of course will be worked against buying the Swiss National Bank. Remember, it is the Swiss who have gone in and sold their own currency drastically in the Forex markets a couple of times now. With that, even though they are more or less concerned with the EUR/CHF pair, there is a bit of a knock on effect when they go in and do that. Because of that, it’s very likely that the pair will bounce hard any time it tries to selloff massively are later the Swiss will run out of patience. It will be directly in this pair, but it most certainly will have an effect on it. With that being said, I like buying.