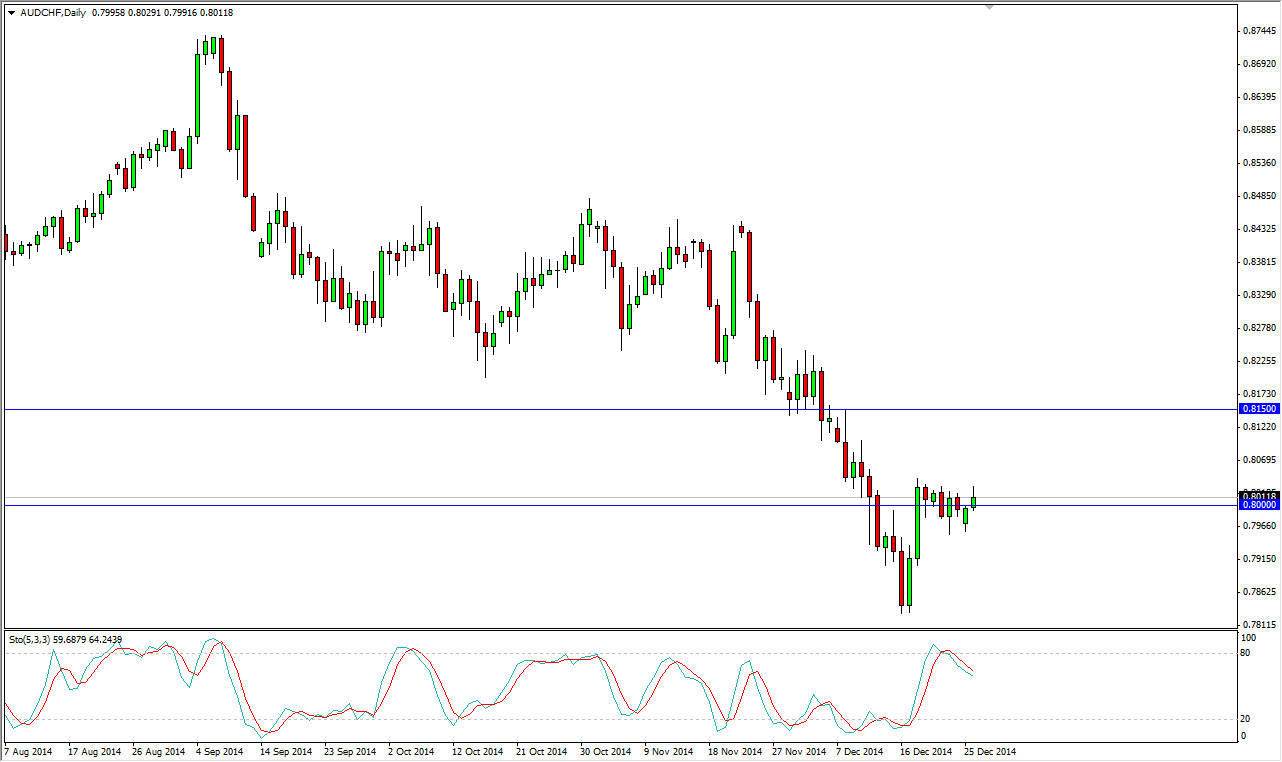

The AUD/CHF pair is one that follows overall risk appetite typically, and as a result will fall as people get a little bit concerned. With that being the case, the other part of this equation is probably the Australian dollar itself, which looks very weak at the moment. With that being the case, I believe that the fact that we formed a shooting star during the session on Friday isn’t much of a surprise, and the fact that it was at the 0.80 level suggests that the sellers are real.

On top of that, I have a stochastic oscillator on the chart, and as it shows, we have had a crossover recently. In other words, it means that we are running out of momentum and it’s very likely that we will turned back around to the downside. Another thing that gets me interested in selling is the fact that we are in a downtrend anyway, so quite frankly it makes sense that the Australian dollar continues to lose value against the Swiss franc just as it has against the US dollar.

Massive resistance above

I believe that there is a significant amount of resistance above anyway, and really we would have to break above the 0.8150 level to start thinking about buying this pair with any seriousness. On top of that, you have to see the gold markets strengthen, and that of course doesn’t look very likely as well as although we have had sudden spikes higher, the reality is that the gold market still are under a lot of pressure due to a strengthening US dollar.

It doesn’t matter we break above the top of the shooting star which would normally have me buying a pair, at that point time it would only be looking for a selling opportunity at the 0.8150 region. Ultimately, I feel that this pair will probably head back down to the 0.78 region, but you also have to keep in mind that it is the least liquid time of the year, so it’s very likely this pair will be a bit erratic overall.