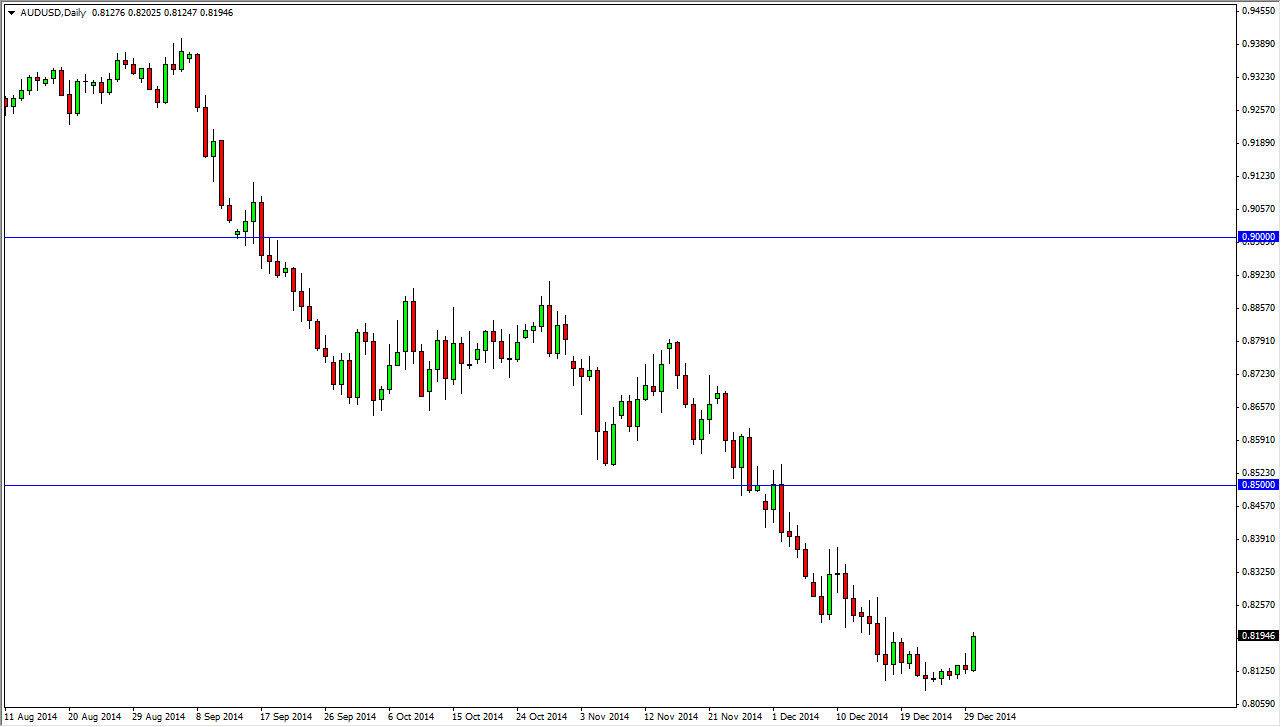

The AUD/USD pair broke out during the session on Tuesday, slashing through quite a bit of resistance that we have seen recently. It doesn’t really matter though, I believe that this candle is a bit of an anomaly, as we might be seeing a bit of profit taking in the short-term. Granted, I believe that the 0.80 level is massively supportive, but we have not tested that level yet. I think that there will be short-term selling opportunities again and again, but we need resistive candles in order to take advantage of the long term downtrend.

The 0.85 level would be an area that I would consider a “ceiling”, but at the end of the day I don’t think we get above there quite yet. If we did, then I would consider the trend changed. Ultimately though, I believe that we will go back down to the 0.80 handle, which is a massive level on the longer-term charts as far as this pair is concerned.

Massive support coming

The 0.80 level is a massive very as far as I can see. That level was a massive resistance barrier, and when we broke out above there it cleared the way for this pair to finally reach parity. On top of that, we are getting relatively close to seeing massive support in the gold markets, and that of course could be a bit of a knock on effect into this particular pair. The US dollar is probably overbought at this point in time, so a significant bounce is almost needed at this point in time.

Ultimately, I don’t know if we continue to go higher, but at this point in time I think we will get a long-term signal fairly soon. In the meantime, I am selling but I recognize that very soon I may have to change my opinion on the Australian dollar in general. The US dollar has been overbought, and now it’s a question as to whether or not the trend would change, or we get some type we could bounce. Nonetheless, stay on your toes, this pair could be rather erratic soon.