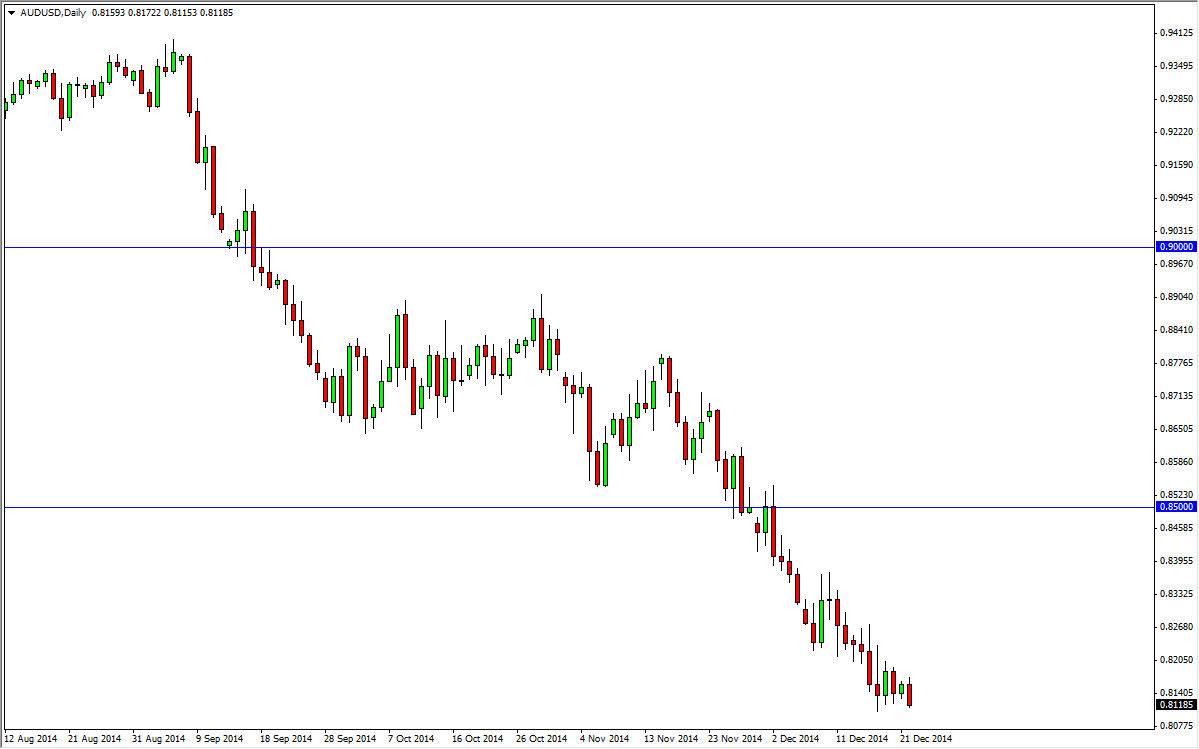

The AUD/USD pair showed weakness again on Monday, showing a continuation of selling pressure every time we rally. The Australian dollar of course will suffer at the hands of a weaker than usual gold market, as gold certainly drives the value of the Australian dollar over the longer term. On top of that, you have to keep in mind that you are pairing up the Australian dollar against the strongest currency in the Forex market, so the fact that the underlying commodity that tends to drives the currency is weak, and the US dollar is so strong, this is more or less a market that should continue to go much lower over the longer term.

The candle of course closed towards the bottom of the session on Monday, so that of course suggests that we should see continued weakness and it’s very likely we could see it right away. It doesn’t really matter though, because I think that the liquidity will keep this market for making massive moves. Ultimately, this market is probably one that you can sell on rallies again and again, as I believe that we will then head to the 0.80 handle given enough time. It’s a large, round, psychologically significant number on the monthly chart, so that of course will carry quite a bit of weight.

Selling should continue

I believe that selling should continue of the longer term, but the question then becomes whether or not we can get below the 0.80 handle. I don’t know that’s going to happen but between now and the end of the year I can’t imagine any significant rally anyway. I will have to reevaluate the AUD/USD pair near the 0.80 handle, because I was the scene of a massive breakout years ago. That should be massively supportive, and I remember very specifically the day that we broke out above the 0.80 handle, because it broke a 16 year high. It was a big deal, so therefore I would assume that market memory should come into play down at that area.