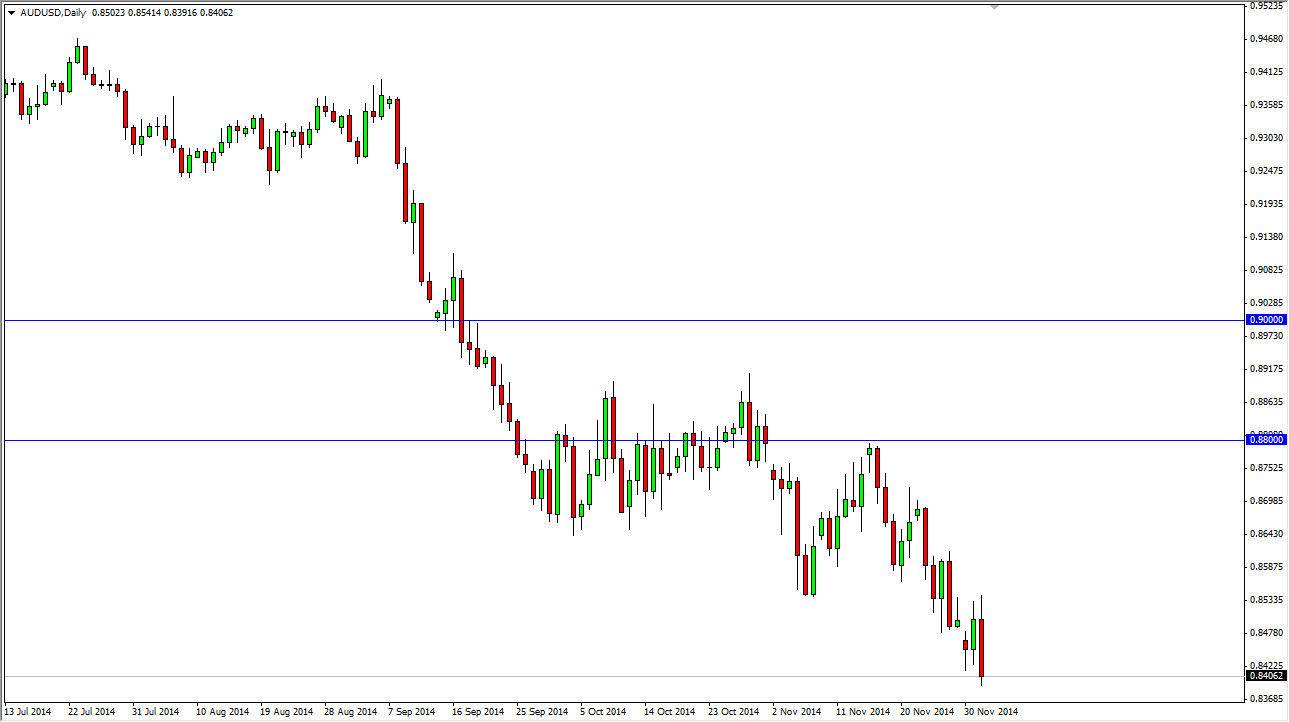

The AUD/USD pair initially tried to rally during the session on Tuesday, but it ended up declining after a weaker than anticipated Australian GDP report. With that being the case, it is probably only a matter of time before we break down much lower, and I believe that the 0.84 level is more than likely going to be the gateway to much lower levels. With that being the case, it is only a matter of time before selling opportunities abound, as the Australian dollar of course is very sensitive to gold markets as well, and they of course don’t necessarily look overly healthy either. With that in mind, it’s more than likely going to be a market that offers plenty of selling opportunities going forward.

Short-term rallies should continue to offer nice selling opportunities as the Australian dollar to simply can’t get out of its own way. The 0.80 level is probably going to be targeted overall, and with that we stay very bearish. With that being the case I can only sell and sell again as there’s no way to imagine buying the Aussie in this particular environment.

Ultimately, the US dollar continues to be favored.

As long as US dollar is so favored, it’s going to be very difficult to go against it anyway. We fight about commodity currencies that makes it even worse, so quite frankly there’s no need for us to get excited about trying to go against it. I believe that this market will fall to the 0.80 handle at the very least, but I also recognize that the market had a significant breakout at that level, so it should end up being a massive support area. It is quite possible that we continue to go lower than they are, but I would anticipate a significant fight in favor of the Australian dollar at the 0.80 handle. Until then though, I think we are heading in that direction and selling should continue to offer plenty of profitable opportunities. With that, I have no interest in buying the Aussie and really don’t even have the argument to do so.