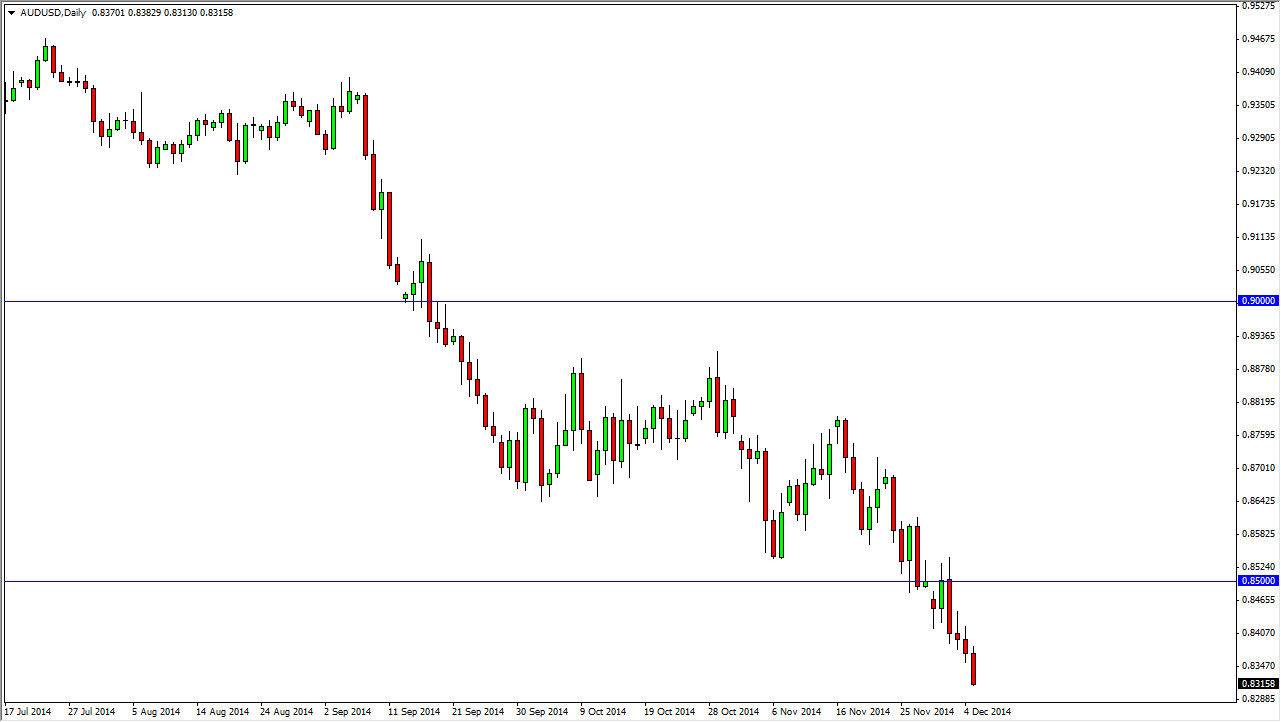

The AUD/USD pair fell during the course of the day on Friday, as the nonfarm payroll numbers came out stronger than anticipated in the United States. With that, I feel that this market is ready to continue its next leg lower, possibly down to the 0.80 handle. With that being the case, I think that the sellers will continue to be in control of a market that has certainly shown a lot of weakness. I believe that rallies will continue to be selling opportunities in a market that has certainly seen quite a bit of bearish pressure. With that being the case, I am looking for rallies to take advantage of a strong downtrend that should continue for the foreseeable future.

The rallies all the way up to the 0.90 level are simple the value plays in the US dollar as far as I can see, and with the way that the gold markets are acting, I don’t anticipate seeing the whole lot of opportunities to buy this market as that essentially means you are willing to go against the power of the greenback.

The 0.80 level is the next target

As far as I can tell, the 0.80 level is the next target in this pair, and we should continue to see sellers step in every time we rally. I think that the area will continue to be important now, as the 0.80 level was the beginning of a major break out to the upside. I remember it very well, just a few years ago we broke through the level and managed to break through 16 years of resistance. That’s a big deal, so I would fully expect this market to remember that area as being very important. With that being the case I am anticipating a move to that level, with a massive buying pressure stepping back in. In fact, I think we could have the trend turned back around in that general vicinity, and therefore we could have an opportunity to sell this market, and then turn around and buy it at the 0.80 level based upon longer-term value.