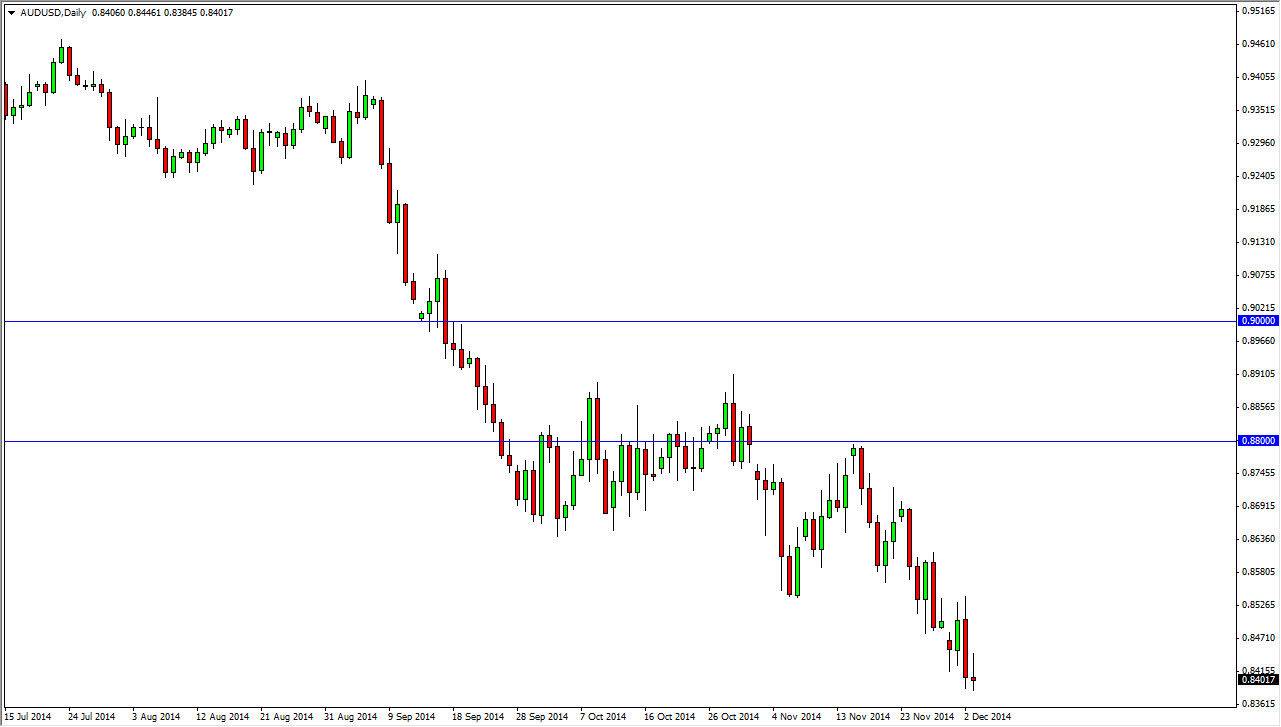

The AUD/USD pair tried to rally during the course of the day on Wednesday, but fell back down to fire off a shooting star shaped candle. A shooting star at the bottom of a large downtrend tells us that the market try to go higher, but simply failed. In other words, the sellers are still very much in control, and the Australian dollar looks as if it’s ready to continue going lower. This is not much of a surprise to me though, because I suggested that once we broke below the 0.85 level, that we were in fact going to head back down to the 0.80 level.

I believe that the 0.80 level is massive in its implications, because it was the site of such a massive breakout a few years back. That is an area that should have plenty of support in it though, so I don’t think we will get below there. If we do, it most certainly gold will have completely collapse. Speaking of gold, it is not helping the Australian dollar much these days, so I think that continues to put a bit of pressure on the Aussie dollar in general.

Rallies will continue to offer value in the US dollar

Rally should continue to offer value in the US dollar, and by that I mean that every time the value of the dollar drops, you should be thinking of it as being “on sale.” I believe that the Australian dollar itself will be heavily punished simply because it is such a heavily reliant currency on the commodity markets, which of course have been brutalized.

Ultimately, I think that it’s a fairly safe bet at this point to suggest that the 0.80 level will be targeted. I really struggle with the idea of that level been broken though, because the last time we went through it to the upside, we had just broken above a 16 year high. That doesn’t happen very often, and I do believe that market memory will come into play. Because of this, I am bearish but not looking to hang onto longer-term moves, as I believe we are starting to get a little overdone.