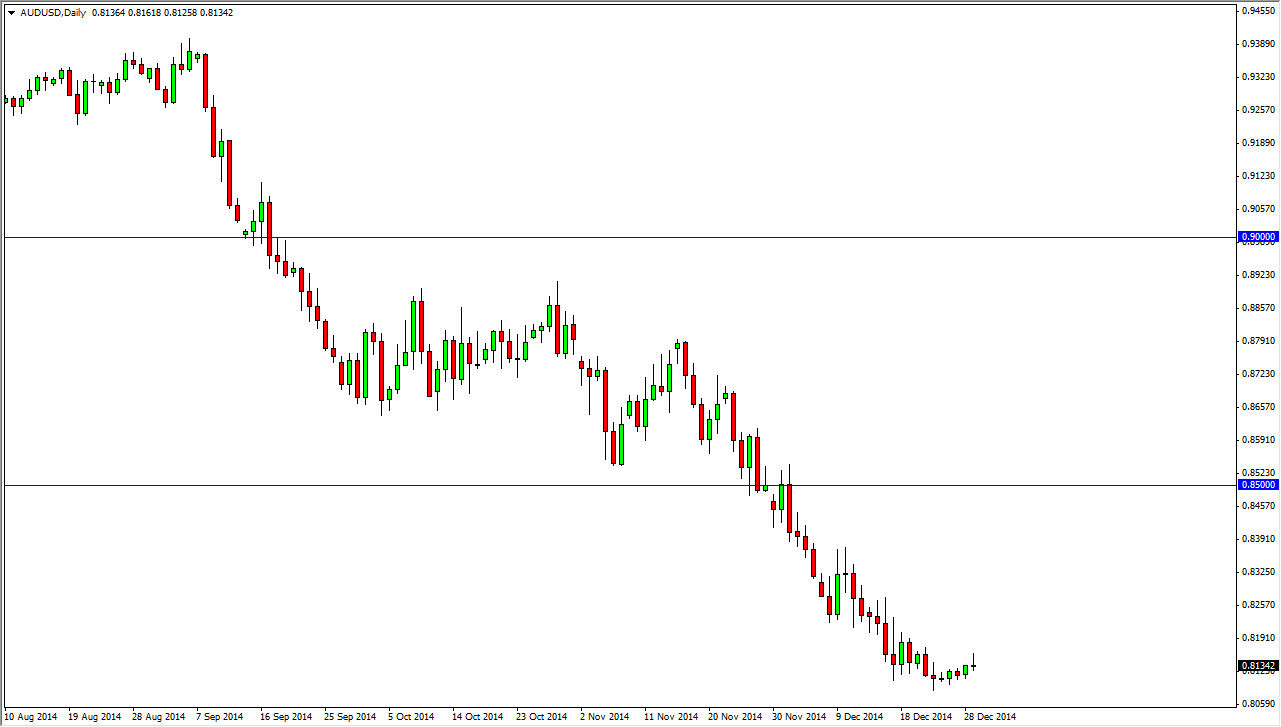

The AUD/USD pair broke higher during the course of the session on Monday, but as you can see pullback in order to form a shooting star. With that being the case, the market looks as if it is ready to continue to sell off every time we try to rally. Ultimately, the market should continue down to the 0.80 handle, and as a result we are very bearish. We think that rallies represent “value” in the US dollar, and as a result it only means that every time we rally that the US dollar has become “cheap.”

With that being said, I believe that short-term rallies will offer short-term selling opportunities. There is in a whole lot of room to go lower from here because I believe that the 0.80 level is massively supportive, but it certainly offers a target for which we can aim.

Massive level

The 0.80 level was a massive resistance area for ages, and as a result I feel that this market will probably struggle to get below there. With that being the case, the market should see a lot of buyers in that area but in the meantime it seems almost like a self-fulfilling prophecy as far as going lower. On the other hand, if we did manage to break above the 0.85 level, I believe that point time you could continue to go long as it would be a bit of a trend change. I definitely think that’s the case by the time we get to the 0.90 level, but quite frankly I think is going to be months before we get that high. In the meantime, I think that you can continue to sell this pair on short-term rallies, aiming for short-term falls. After all, we have seen a massive amount of selling pressure in this market for some time now, so the bearish pressure is getting a bit long in the tooth at this point in time. Nonetheless, it appears we do have a little bit of room to go lower, and I do plan on taking advantage of that.