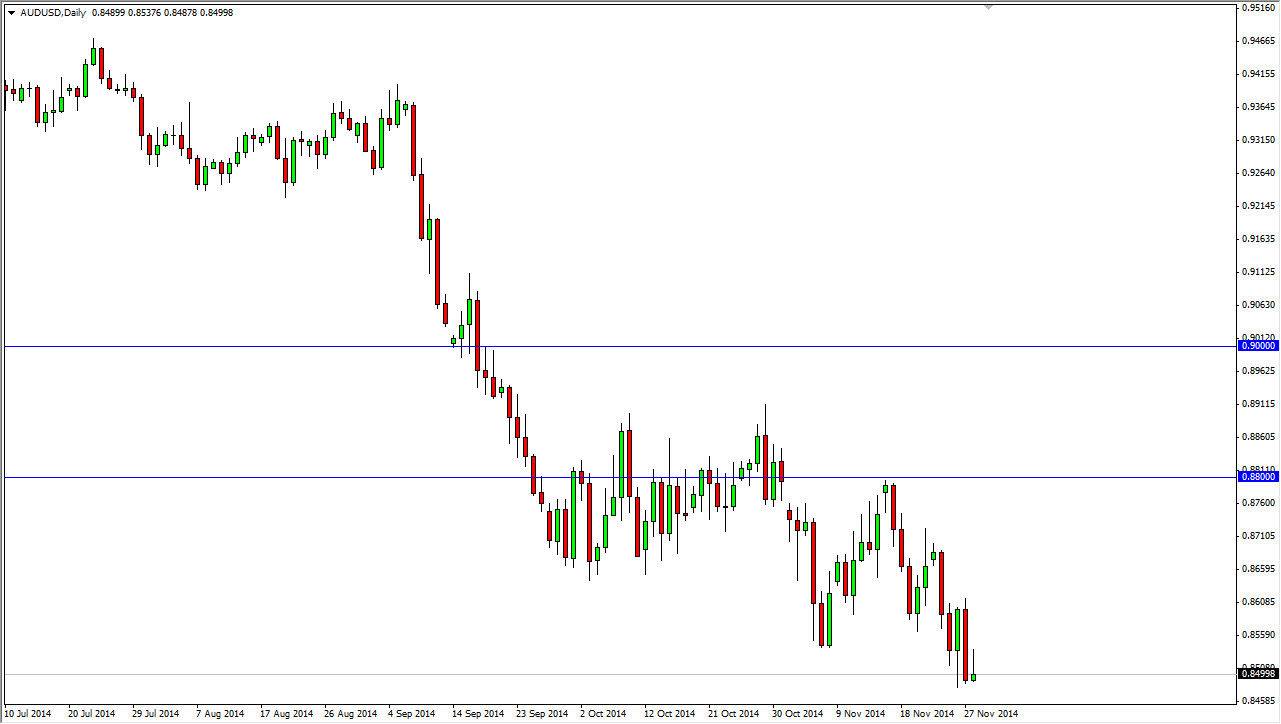

The AUD/USD pair initially tried to rally during the session on Friday, but turned back around and formed a shooting star. Whenever I see a shooting star at the bottom of a longer-term downtrend, that tells me that the buyers in that region tried to pick the pair back up, but could not do it. That’s a good sign for the trend continuing, and the fact that the shooting star sits right at the 0.85 level also tells me that the level is about to get blown through.

With that being said, I believe that the market is one that can be sold every time it rallies now, and most certainly if we make a fresh, new low. The Australian dollar of course is highly tied to the gold market which looks very soft at the moment, and also looks as if it’s ready to go even lower than it has in the past.

One-way trade

Commodities are absolutely miserable right now, so that of course isn’t going to help the Aussie at all. On top of that, the Reserve Bank of Australia has recently complained about how they feel there is serious trouble in the Chinese property market, which is a major consumer of Australian raw materials. With that being the case, it’s essentially like a store who is losing its biggest customer. That of course is no good for the store, just as it is no good for Australia in this particular case.

Ultimately, I believe that this pair goes down to the 0.80 handle given enough time. That was the scene of a very significant breakout on the longer-term charts, and they remember when it happened like it was yesterday. It was a 16 year high getting broken, and it was a huge deal. It looks like we are about to make a complete round-trip at this point in time, and that it’s only a matter of time before we test of that area. I would suspect a lot of buying pressure down there, but I think the next 500 pips are going to be one by the sellers.