By: Stephanie Brown

Many analysts believe that one of the main reasons Bitcoin has so far not been adopted by the masses is due to its ongoing price fluctuations. At the beginning of the year Bitcoin was as high as $900 but as the year progressed prices plummeted to $400. Additionally, the Mt. Gox bankruptcy fiasco sent shockwaves across the industry, causing prices to further decline.

Almost all industry experts believe that the only way the digital currency will be fully adopted is when stability reigns supreme and volatility becomes a thing of the past. However, because Bitcoin is in its nascent stages, volatility will almost definitely remain as investors still try to understand the intricacies of the Bitcoin world.

In other news, it was reported that in light of the Murray report released in November, the Australian Digital Currency Commerce Association (ADCCA) firmly believes that the Bitcoin industry should in fact work alongside the governmental agencies, which will ultimately be able to provide the masses a much more transparent and secure form of crypto-currency. The ADCCA additionally stated that they were delighted to know that the government will encourage innovations in the financial services industry.

Technical Analysis

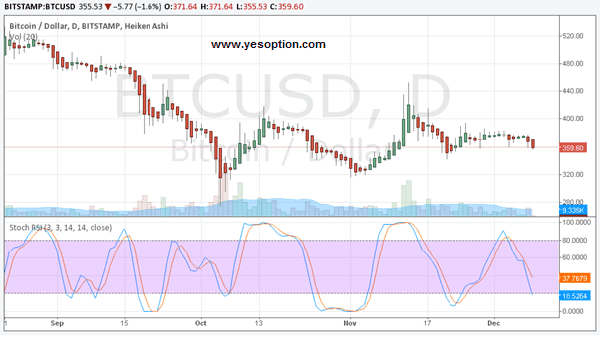

The BTC/USD, after consolidating for almost 10 trading sessions has finally fallen substantially. It does appear likely that this downtrend will continue for some period of time. Currently, the BTC/USD has strong support at $354, $348 and faces resistance at $363, $368.

Actionable Insight

Sell the BTC/USD for a short-term target of $348, $340 with a stop-loss of $363.