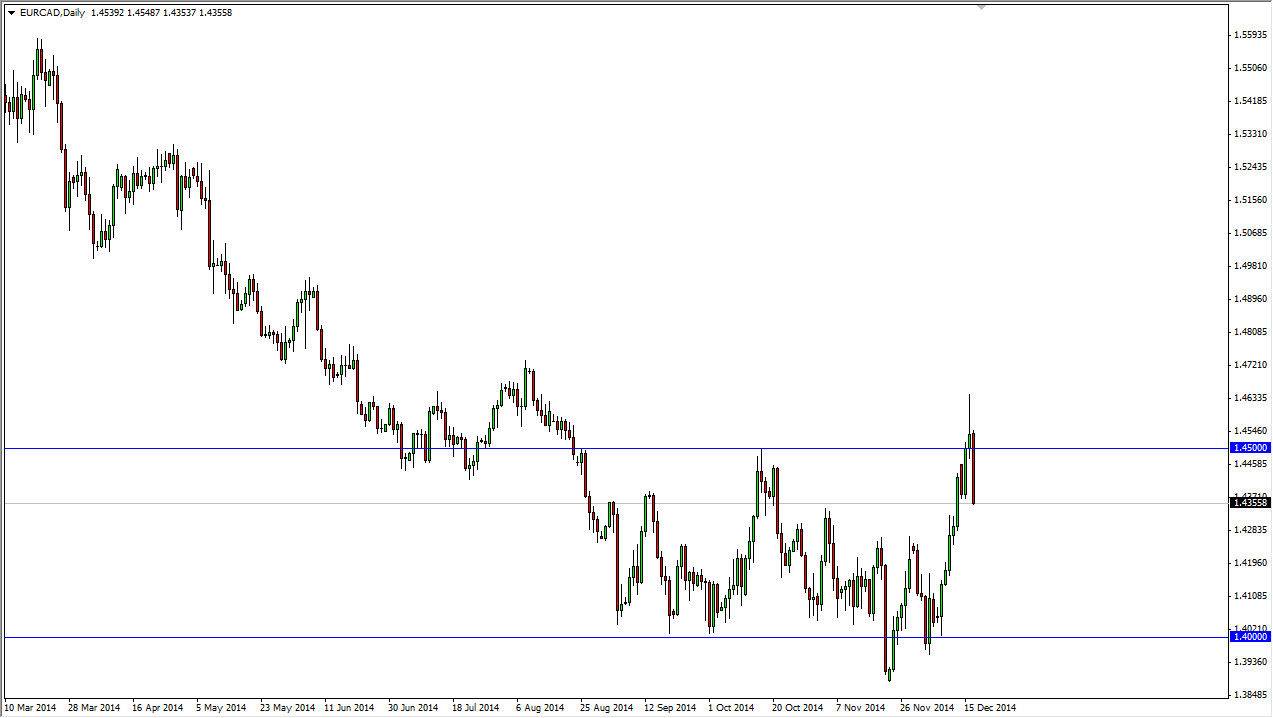

The EUR/CAD pair is one that many of you will ignore. You do so at your own peril though because it does tend to trade much like the EUR/USD pair, but also has the added significance of a simple “Europe versus North America” play. After all, the Canadians do have the oil markets helping them at times, and with oil markets rising during the session on Wednesday after this pair formed a shooting star, this was a very simple trade to take to the downside.

I see a bit of support at the 1.4350 level, but ultimately I think that’s a minor. If we can break down below there, I would anticipate this market heading back down to the 1.41 level, and perhaps even as low as 1.40 level given enough time. With that being the case, I feel that the fact that we closed towards the bottom of the range was very negative also.

Remember, nobody likes the Euro

Closing at the bottom of the range of course is very negative, and quite frankly I think it’s only a matter of time before we really breakdown. Ultimately, I think this pair goes down to the 1.40 level without too many issues, but we might get a short-term bounce. As far as buying is concerned, I don’t think that the trend goes higher until we break the top of the shooting star that was formed on Tuesday, something that doesn’t quite look so likely at this moment in time.

Keep an eye on the oil markets, because if oil goes higher, this pair will go lower. After all, the European Union is struggling and the Canadian dollar is so highly leveraged to the oil markets. But remember the candidate is also highly leveraged to the United States, and that of course helps it against currencies like the Euro. Ultimately, I feel that we probably continue a bit of a downtrend but we could see a little bit of choppiness over the next couple of weeks simply because this isn’t exactly the most heavily traded pair and we are heading towards the holidays.