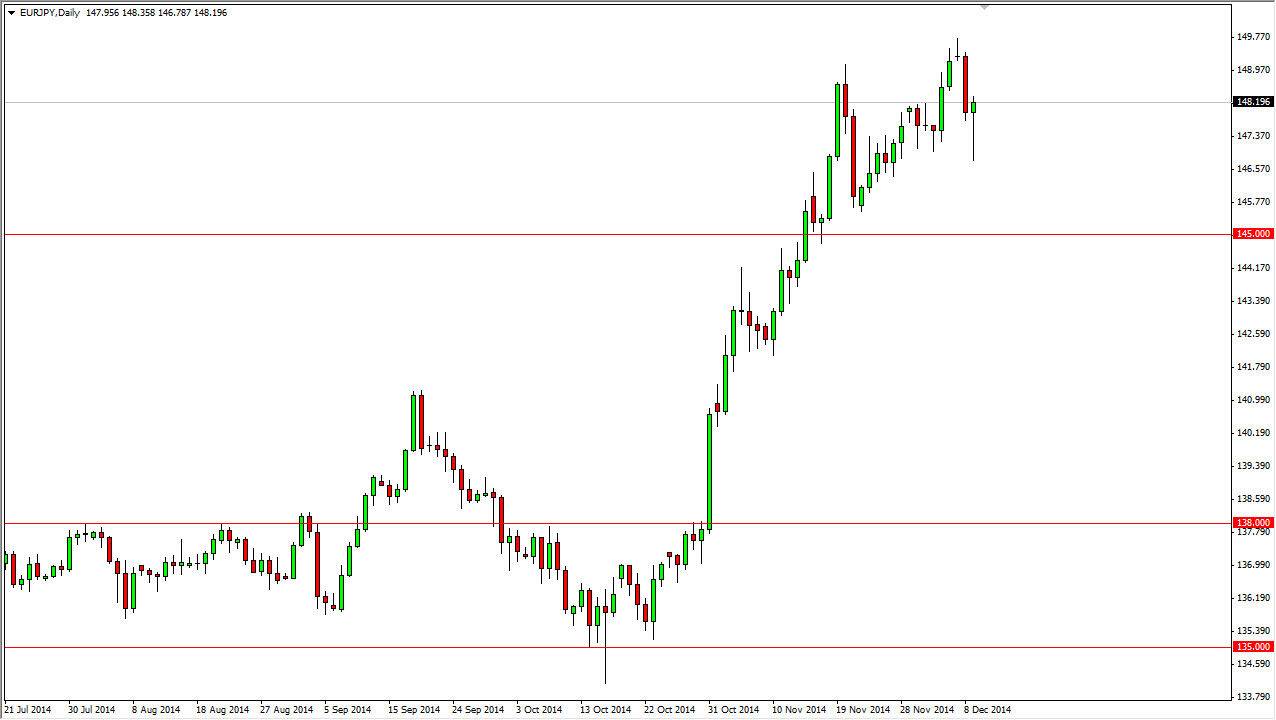

The EUR/JPY pair fell rather hard during the session on Tuesday, but found quite a bit of support at the 156.50 level. With that, I feel that this market should continue to go higher, and that it will find buyers if we can break above the top of this hammer. I think that should send this market looking for the 150 handle, and then possibly even higher than that given enough time. This market is most obviously in an uptrend, and although I don’t like the Euro itself, quite frankly the Japanese yen is getting beat up by just about everything out there right now. This pair will be no different, as I believe it is focusing almost solely on the Japanese yen, and ignoring what’s going on in Europe.

That being said, the 150 level will more than likely be a significant barrier, but we can break above there and continue to grind much higher. I think that will happen given enough time, as the market is most certainly in an uptrend. Ultimately, I think that the Japanese yen is essentially toast at this point.

Continue following the trend

I don’t see any way to go against this trend, and I believe that at this point in time you have to believe the 145 level is the “floor” in this pair. With that being said, I think that a pullback offers value, as the Japanese yen will continue to be worked against by not only the central bank in Japan itself, but also traders looking for returns in various equity markets, bond markets, and of course the Forex markets. I think that it’s only a matter of time before we not only break above the 150 level, but we continue what I believe is going to be a longer-term trend much, much higher.

This pair is starting to look more and more like the EUR/JPY pair of the old “carry trade” days, and I’m going to treat it as such, simply buying every pullback over the longer term as we continue to grind much higher.