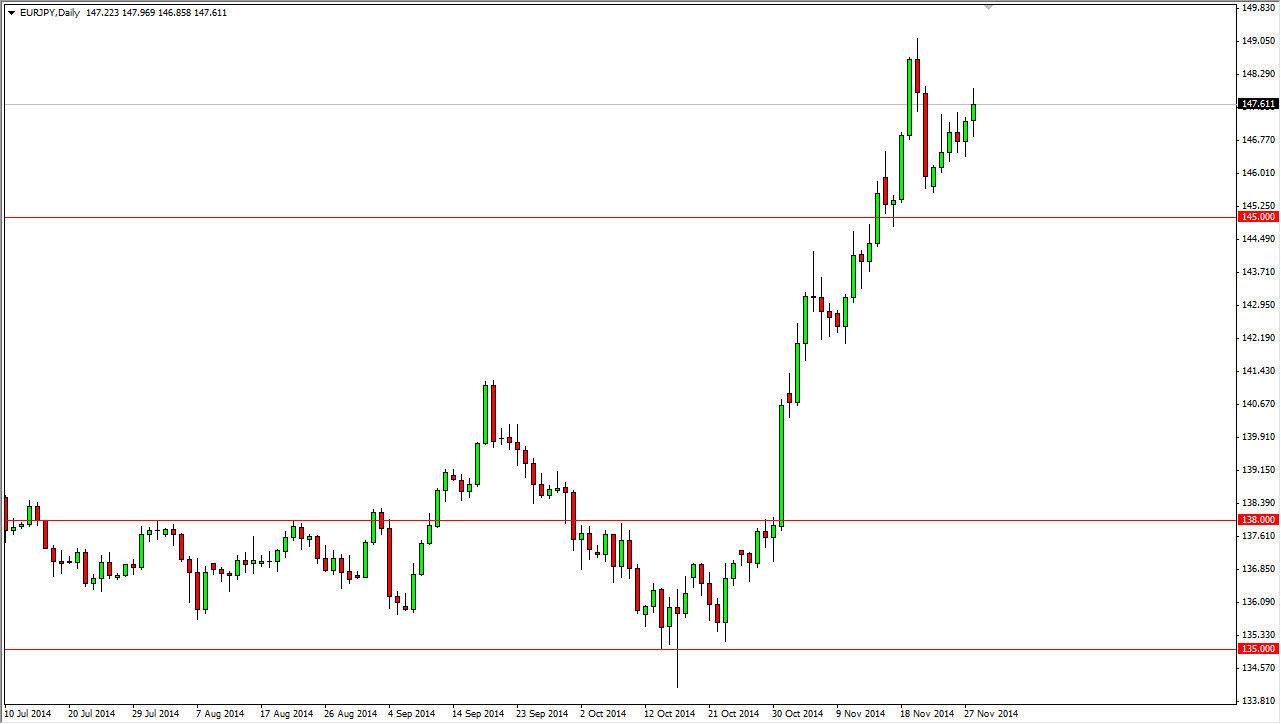

The EUR/JPY pair fell initially during the session on Friday, but as you can see ended up bouncing and showing strength yet again. That being the case, the market looks like it’s ready to grind higher. Keep in mind, that the market is trying to show strength, but this is a relative strength play. In other words, even though the Euro is an absolutely miserable currency to own at the moment, the Japanese yen is in much more trouble than that. That being the case, I believe that the Japanese yen will lose value going forward, and that of course is still going to be the case even with a lowly currencies such as the Euro.

With that being the center of that we find yourselves and, the only thing I can do is buy this pair every time it dips. I believe that we are heading to the next round number, the 150 level. That area could be rather resistive, and as a result I would anticipate to see sellers step into this marketplace and push it back down.

Resistance is futile

Resistance at this point in time in the EUR/JPY pair is futile in my opinion. Don’t get me wrong, we could pullback rather drastically but I feel that the buyers will continue to step in and sell the Japanese yen every time he gets to be a little bit expensive. Yes, even if that means buying the Euro!

Ultimately, I believe that we are in a multi-year uptrend, and that it will continue to go higher and higher given enough time. Longer-term, the market could very easily find itself acting as if it did during the old carry trade days. That being the case, all you had to do was buy the dips in yen related pairs, and I think that’s what we are seeing now. With that, the market should continue to offer plenty of buying opportunities time and time again, as the trend is most certainly set at this point in time.