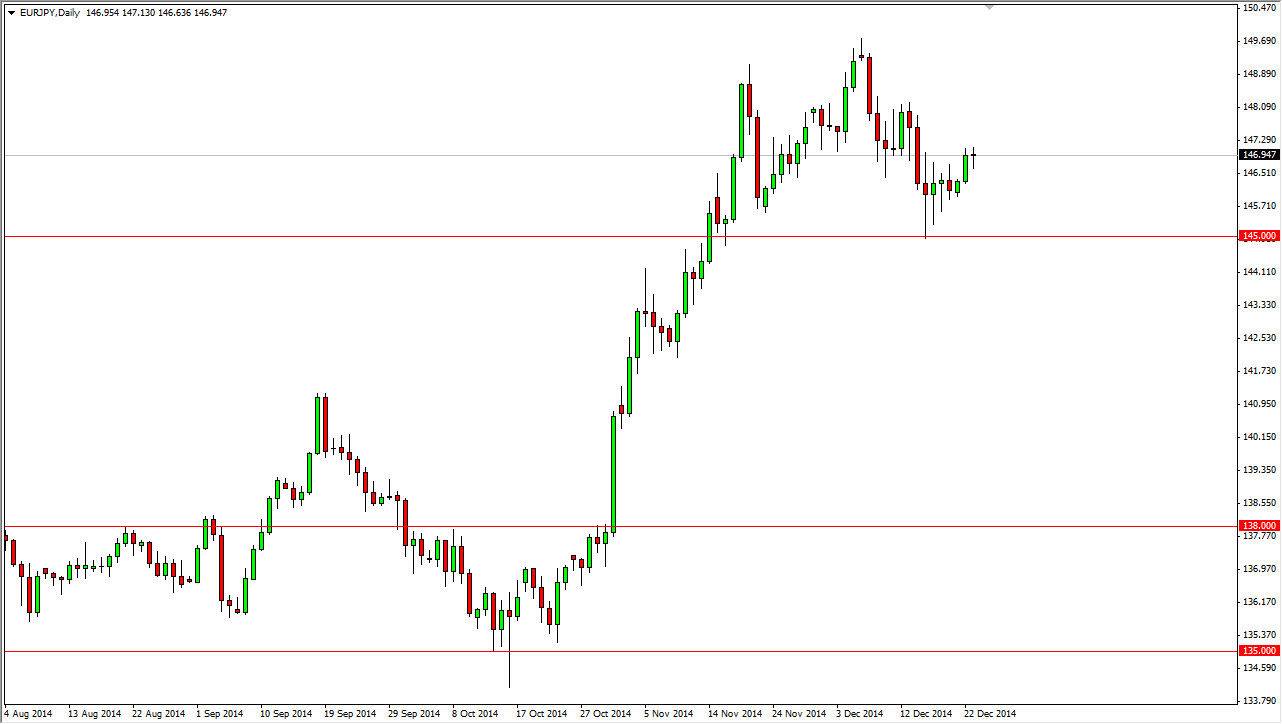

The EUR/JPY pair fell back during the session on Tuesday, but quite frankly we are still well within the consolidation area and therefore I don’t look into this too much. I think that there is plenty of support all the way down to the 145 level, and as a result I am simply looking for some type of supportive candle in order to continue the uptrend. I recognize that we are just one day ahead of Christmas, and as a result it’s very likely that liquidity is going to be almost nonexistent. I don’t look for any type of significant move, but a supportive move between here and the 145 level of course does have me interested as it goes with the longer-term trend.

The Japanese yen continues to be one of the least favored currencies in the Forex markets right now, and although I don’t necessarily like the Euro, I think this pair is more about the Yen than anything else. With that, I’m hoping to get a pullback to form some type of supportive candle in order to buy this market and aim for the 150 level, an area of significant resistance that we have recently challenged.

Big round figure

The 150 level is as big of a round figure as you can possibly get. It is because of this that I think the market will be attracted to that level, and it may have to pullback several times in order to build up enough momentum to break above. However, we certainly can do that, and I don’t see why we won’t. With that, I remain bullish but recognize that a lot of choppiness around may need to be done over the next couple of weeks in this general vicinity.

I look at this market as consolidating, between the 145 level on the bottom, and the 150 level on the top. Between here and there, expect a lot of volatility but I still have an upward bias as the trend certainly has shown. I have no interest in selling this pair and therefore will stay away from sell signals.